Negative

21Serious

Neutral

Optimistic

Positive

- Total News Sources

- 3

- Left

- 2

- Center

- 1

- Right

- 0

- Unrated

- 0

- Last Updated

- 60 days ago

- Bias Distribution

- 67% Left

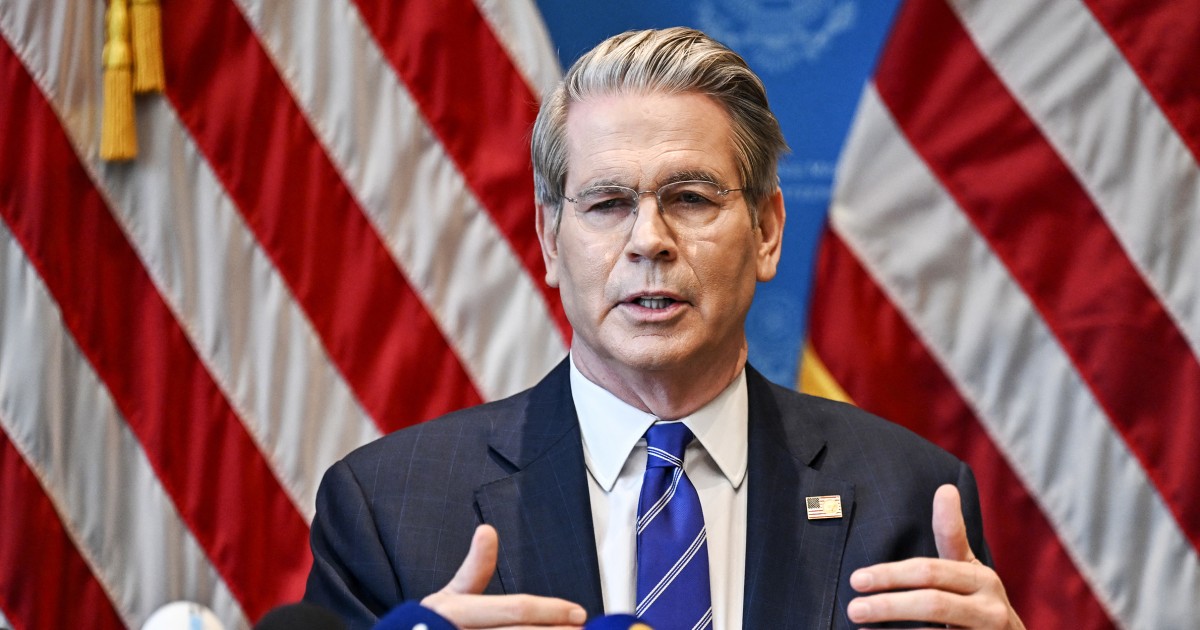

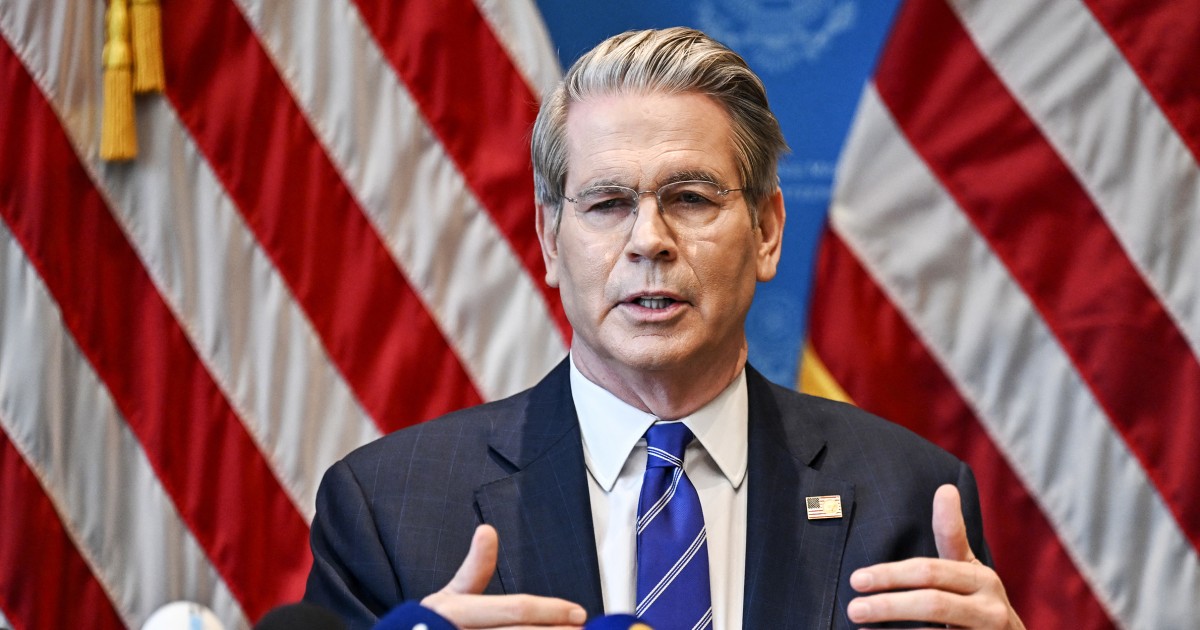

US Treasury Secretary Dismisses Moody’s Credit Downgrade Amid $36 Trillion Debt

U.S. Treasury Secretary Scott Bessent dismissed Moody's recent downgrade of the U.S. credit rating from Aaa to Aa1 as a "lagging indicator," attributing the increased government debt to spending policies over the past four years under the Biden administration rather than recent developments. Moody's cited a decade-long rise in government debt and interest payments, projecting that deficits could widen to nearly 9% of GDP by 2035 due to increased entitlement spending and low revenue generation. Bessent emphasized that the administration is committed to reducing spending and fostering economic growth to counter these trends. He also noted that large retailers like Walmart are absorbing some tariff costs to mitigate price increases for consumers, despite inflationary concerns. The downgrade, the last triple-A rating removal by Moody's among major agencies, reflects long-term fiscal challenges rather than immediate economic conditions. This viewpoint was consistent across multiple media outlets covering Bessent's remarks, including NBC News, Bloomberg, and Free Malaysia Today.

- Total News Sources

- 3

- Left

- 2

- Center

- 1

- Right

- 0

- Unrated

- 0

- Last Updated

- 60 days ago

- Bias Distribution

- 67% Left

Negative

21Serious

Neutral

Optimistic

Positive

Stay in the know

Get the latest news, exclusive insights, and curated content delivered straight to your inbox.

Gift Subscriptions

The perfect gift for understanding

news from all angles.