- Total News Sources

- 8

- Left

- 3

- Center

- 3

- Right

- 2

- Unrated

- 0

- Last Updated

- 22 days ago

- Bias Distribution

- 38% Center

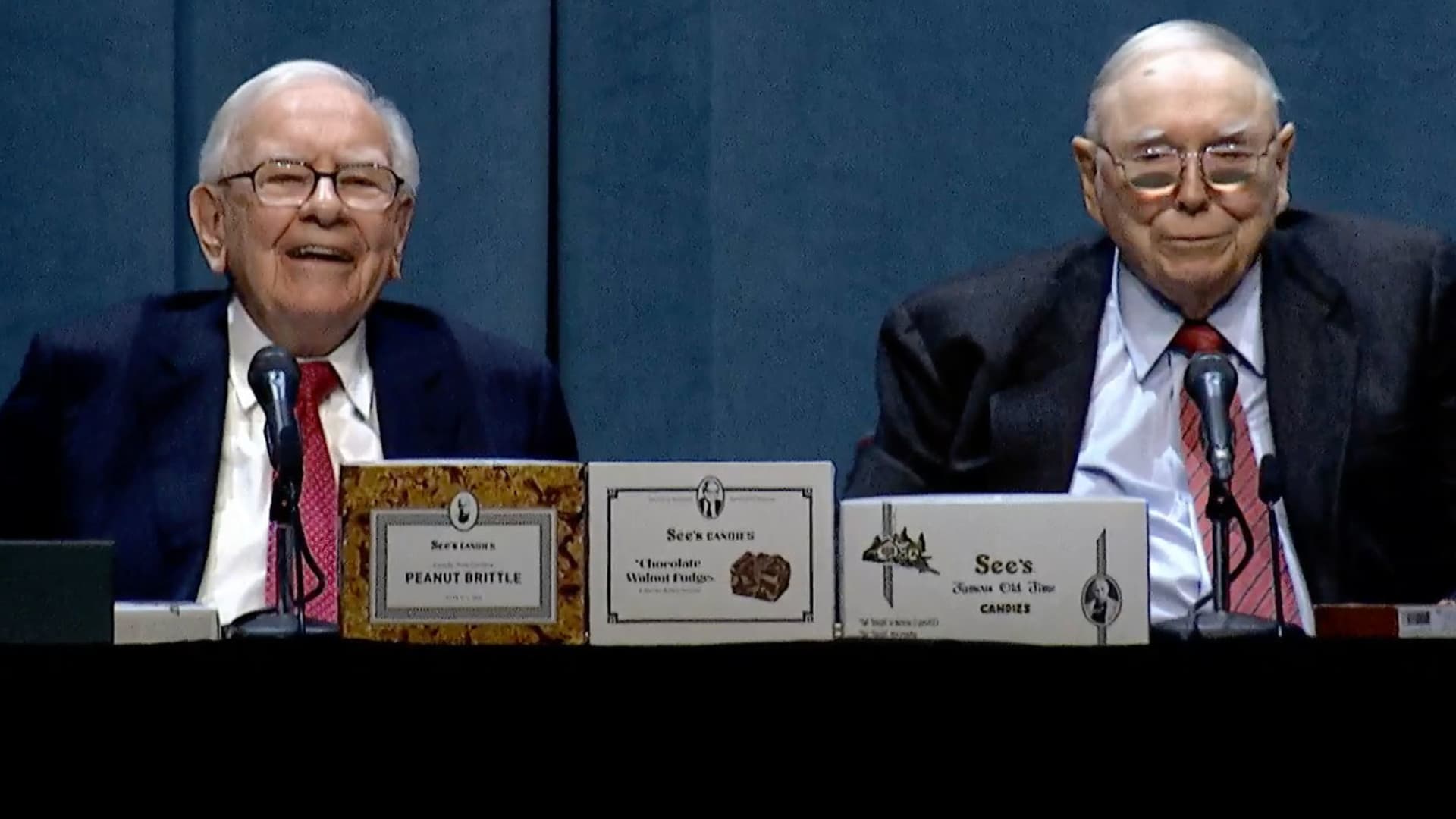

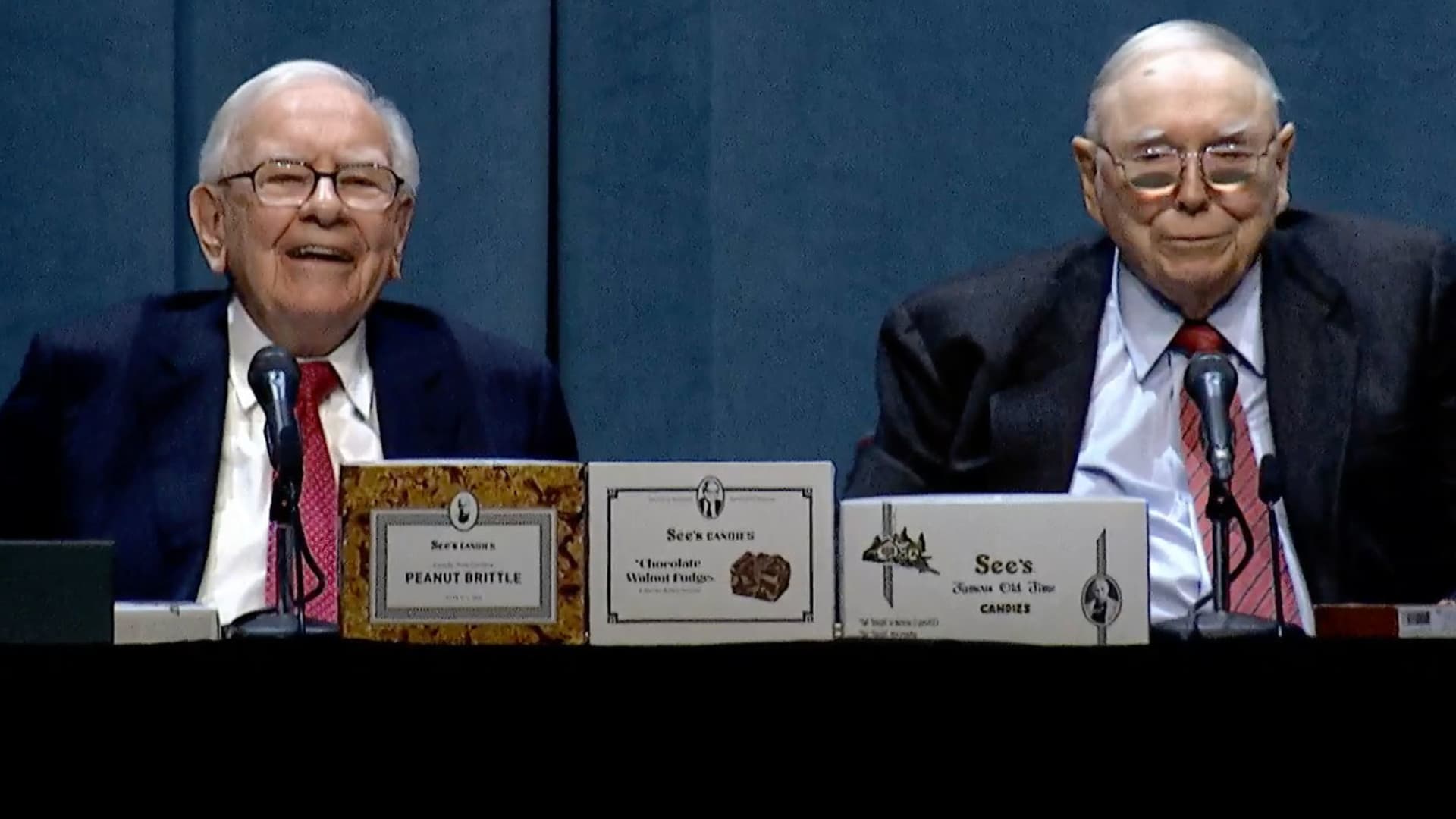

Berkshire Hathaway Fully Exits BYD; Shares Fall

Berkshire Hathaway has fully exited its 17-year investment in Chinese electric-vehicle maker BYD, with Berkshire Hathaway Energy’s filing listing the holding as zero as of March 31 and the exit confirmed to CNBC. The stake began in 2008 with a roughly $230 million purchase of 225 million shares at Charlie Munger’s urging and grew to about $9 billion at its peak, generating an estimated roughly 30x return (about $7–10 billion). Berkshire began selling down the position in mid-2022, pared below the 5% disclosure threshold by mid-2024, and completed the divestment by March 2025. The divestment comes as BYD has reported a recent profit decline, months of falling domestic deliveries, a fierce price war, rising competition in China and Europe, and tariff and geopolitical headwinds that have prompted other Western investors to trim exposure. BYD shares fell roughly 3–3.4% in Hong Kong after the news; BYD publicly thanked Buffett and Munger for 17 years of “investment, help and companionship” and called the sales normal market activity, while Buffett has not given detailed reasons beyond saying he expects to find things to do with the money he prefers and Berkshire is reallocating capital.

- Total News Sources

- 8

- Left

- 3

- Center

- 3

- Right

- 2

- Unrated

- 0

- Last Updated

- 22 days ago

- Bias Distribution

- 38% Center

Related Topics

Stay in the know

Get the latest news, exclusive insights, and curated content delivered straight to your inbox.

Gift Subscriptions

The perfect gift for understanding

news from all angles.