Negative

21Serious

Neutral

Optimistic

Positive

- Total News Sources

- 2

- Left

- 0

- Center

- 0

- Right

- 2

- Unrated

- 0

- Last Updated

- 32 days ago

- Bias Distribution

- 100% Right

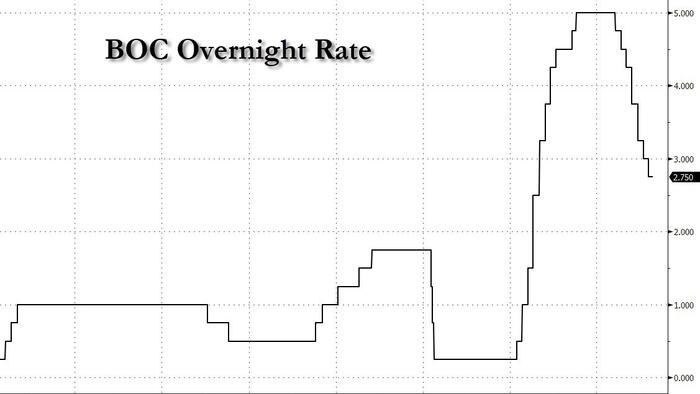

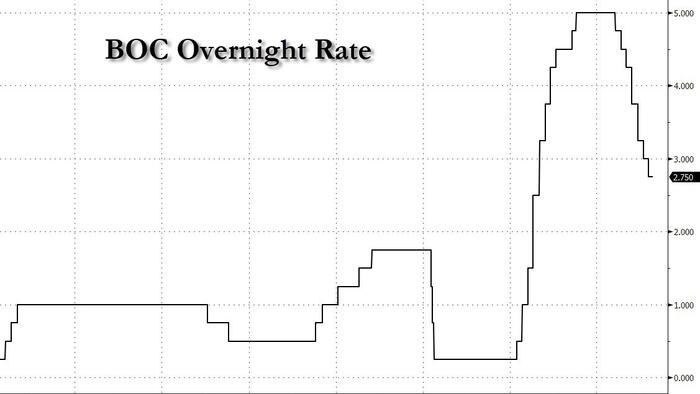

Bank of Canada Holds Rates at 2.75%, Warns of Recession due to US Tariffs

The Bank of Canada has paused its key policy rate at 2.75%, following a series of cuts, due to heightened uncertainty from U.S. tariffs and shifting trade policy, which have diminished economic growth prospects and raised inflation expectations. The central bank noted declining consumer and business confidence, weaker spending, and signs of a slowing labor market. Instead of its usual economic forecast, the bank outlined two scenarios: one where tariffs are lifted and growth resumes later in 2025, and another where a prolonged trade war triggers a recession and temporarily higher inflation. The Bank indicated it will proceed cautiously, monitoring risks and uncertainties, and remains prepared to act decisively if conditions change. In the near term, inflation is expected to dip due to lower carbon taxes and crude prices, but may rise if trade disruptions persist. Ultimately, the bank emphasized that monetary policy cannot resolve trade tensions, but will focus on maintaining price stability and supporting growth.

- Total News Sources

- 2

- Left

- 0

- Center

- 0

- Right

- 2

- Unrated

- 0

- Last Updated

- 32 days ago

- Bias Distribution

- 100% Right

Negative

21Serious

Neutral

Optimistic

Positive

Related Topics

Stay in the know

Get the latest news, exclusive insights, and curated content delivered straight to your inbox.

Gift Subscriptions

The perfect gift for understanding

news from all angles.