- Total News Sources

- 8

- Left

- 3

- Center

- 2

- Right

- 3

- Unrated

- 0

- Last Updated

- 19 days ago

- Bias Distribution

- 38% Right

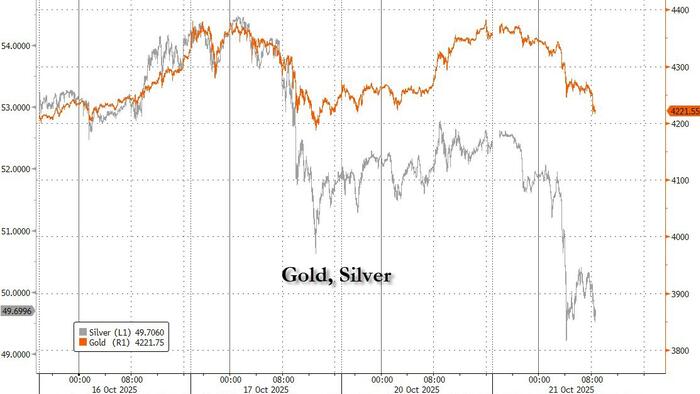

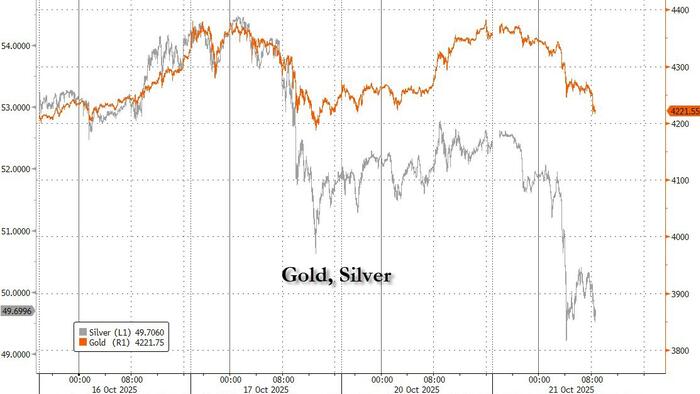

Gold Falls 6.3%, Steepest Drop Since 2013

Gold fell as much as 6.3% — its steepest one-day drop since 2013 — after hitting record highs near $4,381 an ounce following a blistering 2025 rally. Traders and analysts said the retreat was largely profit-taking in an overbought market, amplified by a firmer dollar, easing U.S.-China trade tensions and specific comments from President Trump about potential talks with Xi, as well as the end of seasonal Diwali buying. Silver and gold miners were hit even harder, and one‑month implied volatility spiked as traders bought protection. Many market participants described the move as a positioning purge rather than a structural reversal, noting that underlying drivers — central-bank demand, debasement fears and potential Fed rate cuts — could still support bullion. Investors will be watching upcoming U.S. CPI data, the Fed outlook and trade diplomacy for signals on whether the rally resumes or consolidates.

- Total News Sources

- 8

- Left

- 3

- Center

- 2

- Right

- 3

- Unrated

- 0

- Last Updated

- 19 days ago

- Bias Distribution

- 38% Right

Related Topics

Stay in the know

Get the latest news, exclusive insights, and curated content delivered straight to your inbox.

Gift Subscriptions

The perfect gift for understanding

news from all angles.