- Total News Sources

- 12

- Left

- 3

- Center

- 5

- Right

- 3

- Unrated

- 1

- Last Updated

- 16 days ago

- Bias Distribution

- 45% Center

Novartis to Buy Avidity for About $12 Billion

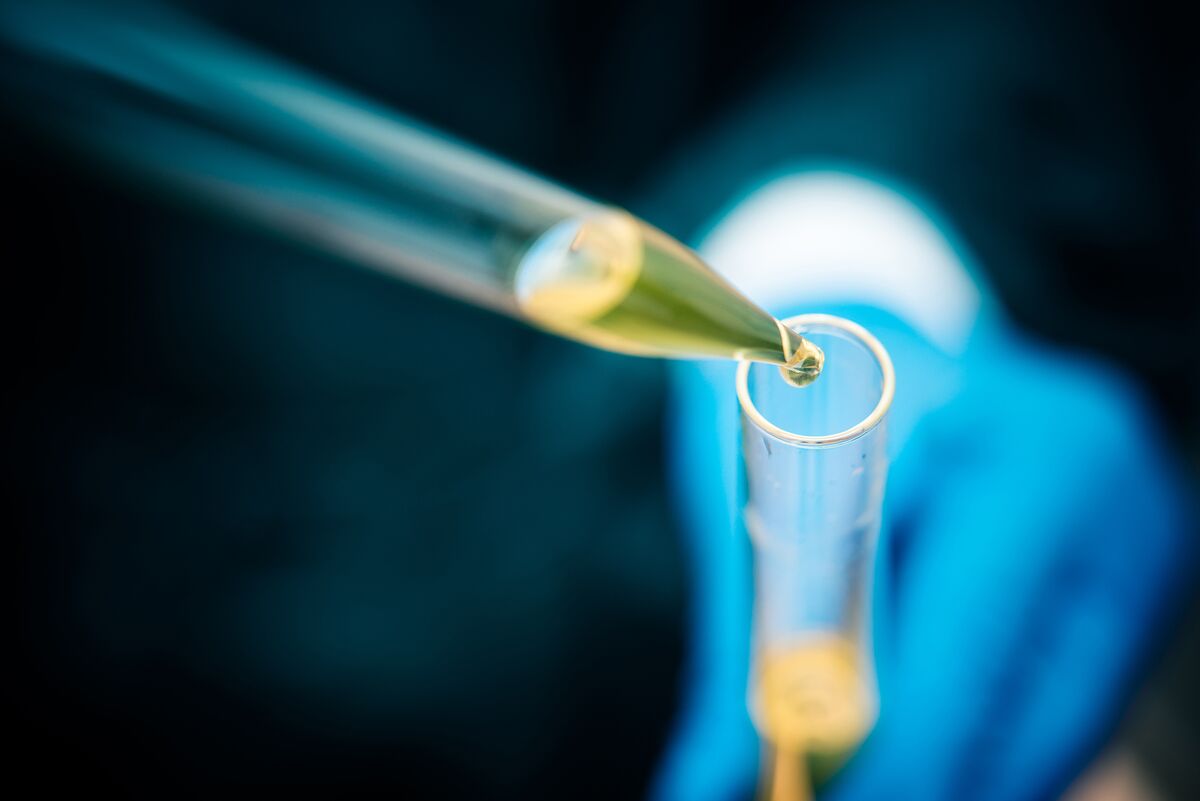

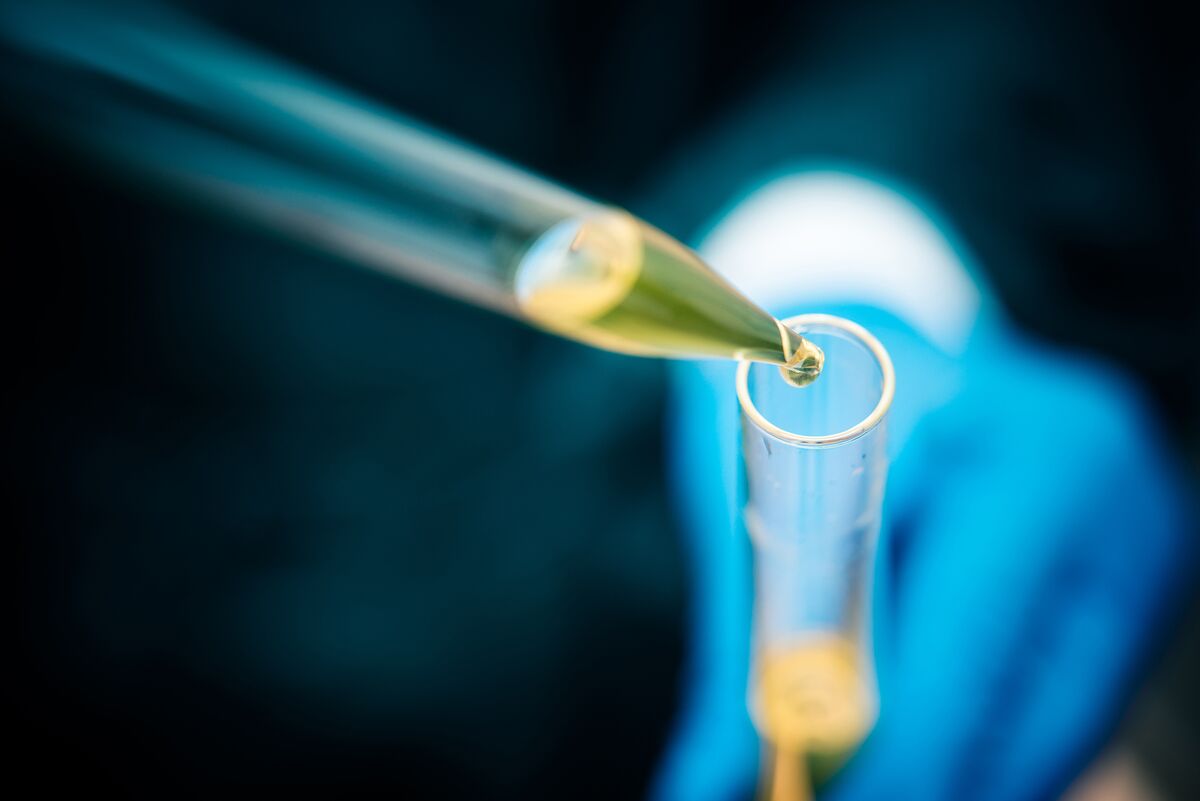

Novartis agreed to acquire San Diego–based Avidity Biosciences for $72 per share in cash, valuing the company at about $12 billion and representing roughly a 46% premium. The deal is slated to close in the first half of 2026. Avidity’s antibody‑oligonucleotide conjugate (AOC) platform — including late‑stage programs for Duchenne muscular dystrophy, myotonic dystrophy type 1 and facioscapulohumeral muscular dystrophy — is intended to bolster Novartis’s neuroscience pipeline and provide near‑term launch opportunities. Under the terms, Avidity will spin off its early‑stage cardiovascular assets into a separate publicly tradable company, with Avidity shareholders receiving shares in the new entity or cash in certain circumstances. The announcement sent Avidity shares sharply higher in premarket trading (up roughly 40–43% to about $70.50 after a $49.15 close), and Novartis said the acquisition gives it a differentiated RNA delivery platform that complements its growing U.S. research footprint.

- Total News Sources

- 12

- Left

- 3

- Center

- 5

- Right

- 3

- Unrated

- 1

- Last Updated

- 16 days ago

- Bias Distribution

- 45% Center

Related Topics

Stay in the know

Get the latest news, exclusive insights, and curated content delivered straight to your inbox.

Gift Subscriptions

The perfect gift for understanding

news from all angles.