- Total News Sources

- 2

- Left

- 1

- Center

- 1

- Right

- 0

- Unrated

- 0

- Last Updated

- 225 days ago

- Bias Distribution

- 50% Center

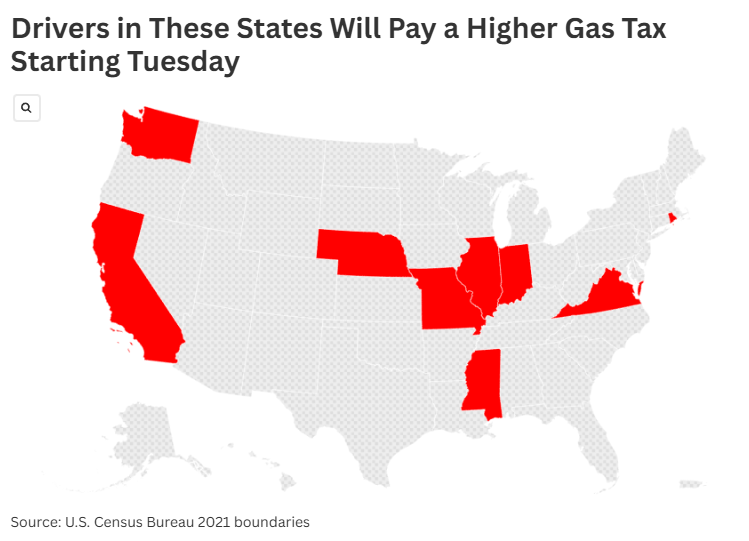

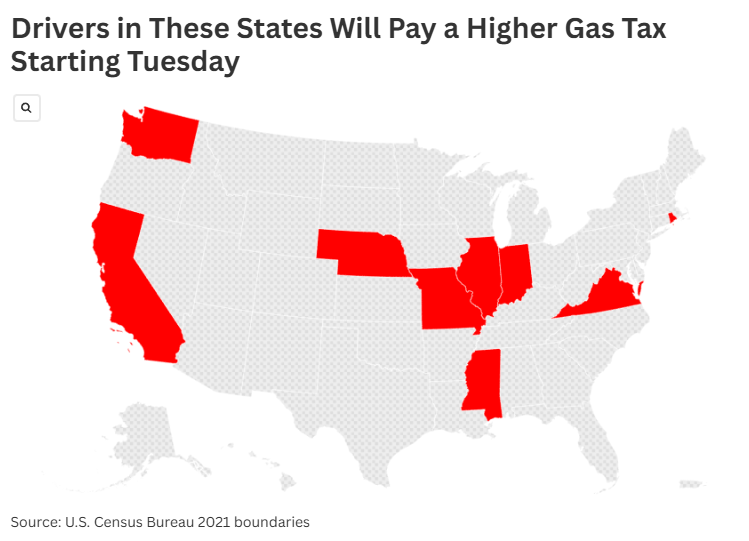

Illinois Gas Tax Rises 2.77 Percent July 1 Amid Multi-State Increases

Illinois drivers are facing an increase in gasoline and diesel taxes as of July 1, with the gas tax rising from 47 cents to 48.3 cents per gallon and diesel from 54.5 cents to 55.8 cents per gallon. This marks the sixth tax increase since 2019, and Illinois now has the second-highest gas tax rate in the nation, prompting some consumers near state borders to purchase fuel in neighboring states like Indiana. Local businesses, such as delivery services, report that higher fuel costs are impacting their operations and could negatively affect local economies by reducing spending elsewhere. The tax increases are part of inflation adjustments established by state law to fund road maintenance and infrastructure projects. Other states, including California and Mississippi, are also implementing gas tax hikes around the same time, reflecting a broader trend of rising fuel taxes nationwide. Illinois residents will also see increases in taxes on tobacco and vape products, contributing to the overall rise in state levies.

- Total News Sources

- 2

- Left

- 1

- Center

- 1

- Right

- 0

- Unrated

- 0

- Last Updated

- 225 days ago

- Bias Distribution

- 50% Center

Related Topics

Stay in the know

Get the latest news, exclusive insights, and curated content delivered straight to your inbox.

Gift Subscriptions

The perfect gift for understanding

news from all angles.