Negative

26Serious

Neutral

Optimistic

Positive

- Total News Sources

- 3

- Left

- 2

- Center

- 0

- Right

- 1

- Unrated

- 0

- Last Updated

- 2 hours ago

- Bias Distribution

- 67% Left

IBIT Surpasses MicroStrategy, Hits 700,000 BTC

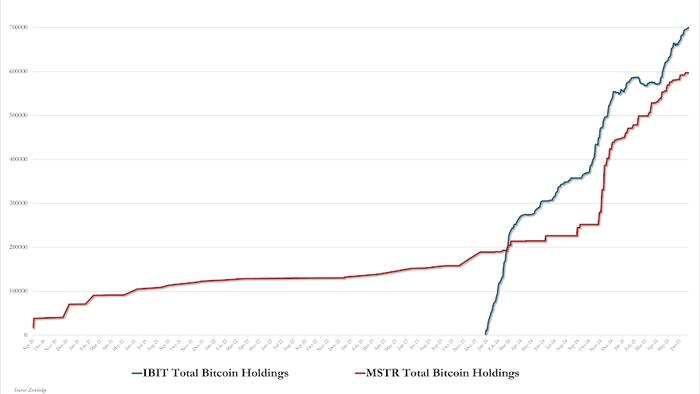

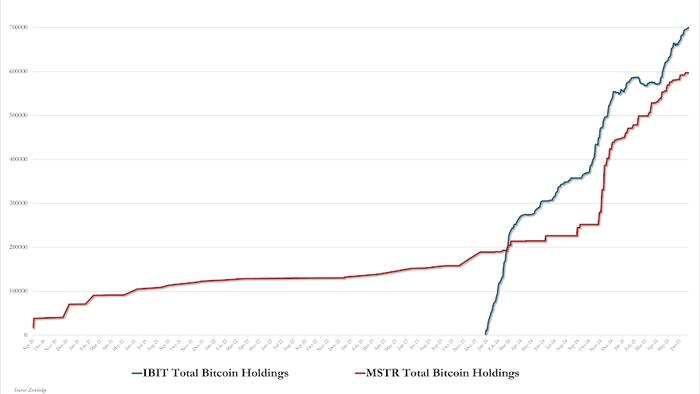

BlackRock's iShares Bitcoin Trust (IBIT) has surpassed 700,000 BTC in assets under management, valued at approximately $75–76 billion, just 18 months after its January 2024 launch. IBIT is now the leading U.S. spot Bitcoin ETF, holding over 55% of total BTC in such funds and outpacing competitors like Fidelity’s FBTC and Grayscale’s GBTC. In June alone, IBIT attracted over $3.7 billion in net inflows, and recent trading volume increases signal renewed interest from institutional and retail investors. The ETF has also overtaken MicroStrategy as the largest corporate or institutional Bitcoin holder after Satoshi Nakamoto. IBIT now generates more revenue for BlackRock than flagship funds like the iShares Core S&P 500 ETF. All U.S. spot Bitcoin ETFs now control nearly 6% of Bitcoin’s total supply, underscoring Bitcoin's growing mainstream and institutional adoption.

- Total News Sources

- 3

- Left

- 2

- Center

- 0

- Right

- 1

- Unrated

- 0

- Last Updated

- 2 hours ago

- Bias Distribution

- 67% Left

Negative

26Serious

Neutral

Optimistic

Positive

Related Topics

Stay in the know

Get the latest news, exclusive insights, and curated content delivered straight to your inbox.

Gift Subscriptions

The perfect gift for understanding

news from all angles.