Negative

22Serious

Neutral

Optimistic

Positive

- Total News Sources

- 1

- Left

- 1

- Center

- 0

- Right

- 0

- Unrated

- 0

- Last Updated

- 13 days ago

- Bias Distribution

- 100% Left

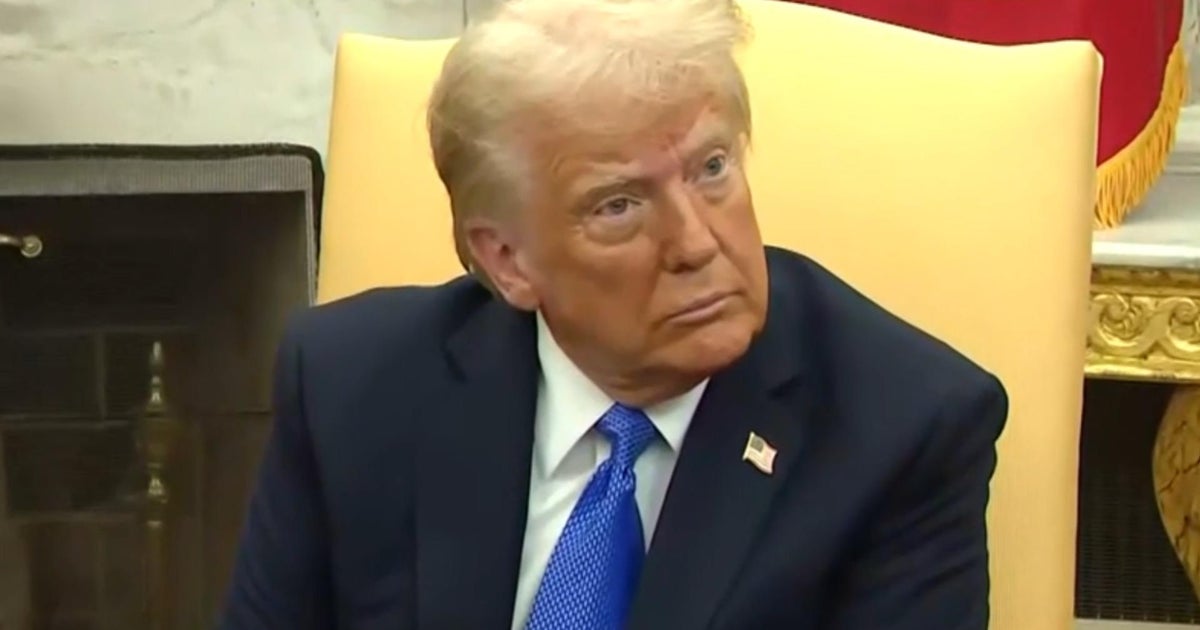

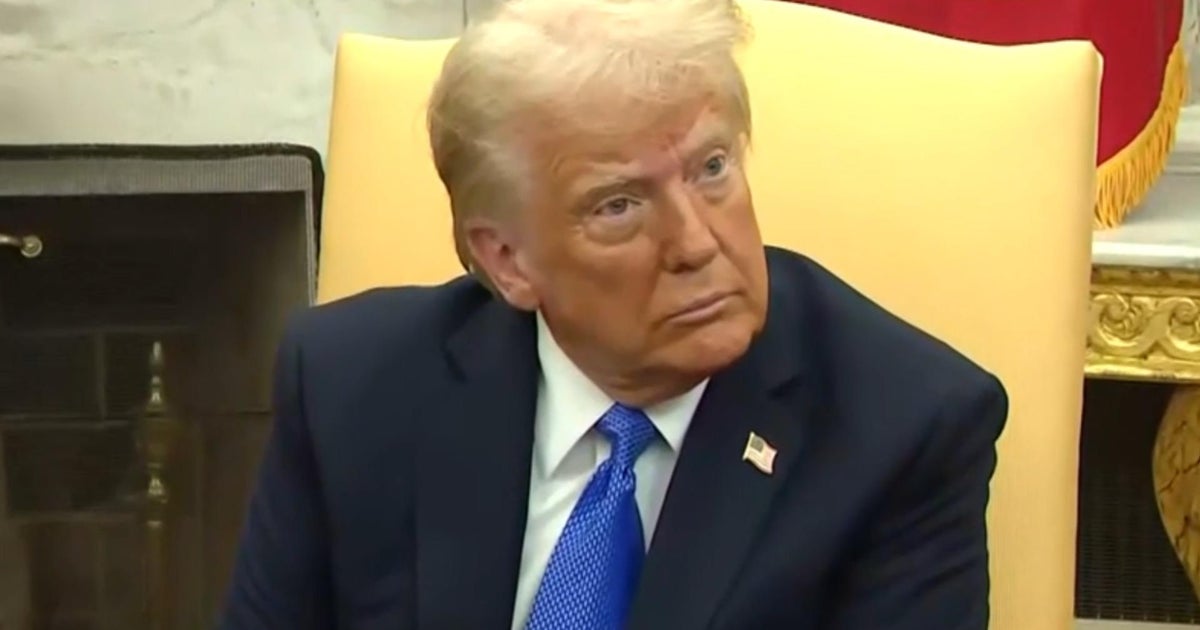

Trump, Baldwin propose closing carried interest tax loophole

President Trump is advocating to eliminate the carried interest tax deduction loophole, which allows investment fund managers to pay lower taxes on their income compared to regular workers. This tax break, historically criticized for favoring the wealthy, permits fund managers to categorize a significant portion of their income as capital gains, taxed at a lower rate than ordinary income. Trump's proposal aligns with recent efforts from Democratic lawmakers, notably Senator Tammy Baldwin, who has introduced the Carried Interest Fairness Act to change the tax treatment of carried interest to match that of regular income. The president's tax priorities also include no taxes on senior Social Security and overtime pay, alongside renewing 2017 tax cuts. However, the success of these proposals may hinge on bipartisan support, as both parties have significant financial interests at stake. Analysts note that the elimination of this loophole could potentially increase tax revenue by about $100 billion over the next decade.

- Total News Sources

- 1

- Left

- 1

- Center

- 0

- Right

- 0

- Unrated

- 0

- Last Updated

- 13 days ago

- Bias Distribution

- 100% Left

Negative

22Serious

Neutral

Optimistic

Positive

Stay in the know

Get the latest news, exclusive insights, and curated content delivered straight to your inbox.

Gift Subscriptions

The perfect gift for understanding

news from all angles.