Negative

20Serious

Neutral

Optimistic

Positive

- Total News Sources

- 1

- Left

- 1

- Center

- 0

- Right

- 0

- Unrated

- 0

- Last Updated

- 108 days ago

- Bias Distribution

- 100% Left

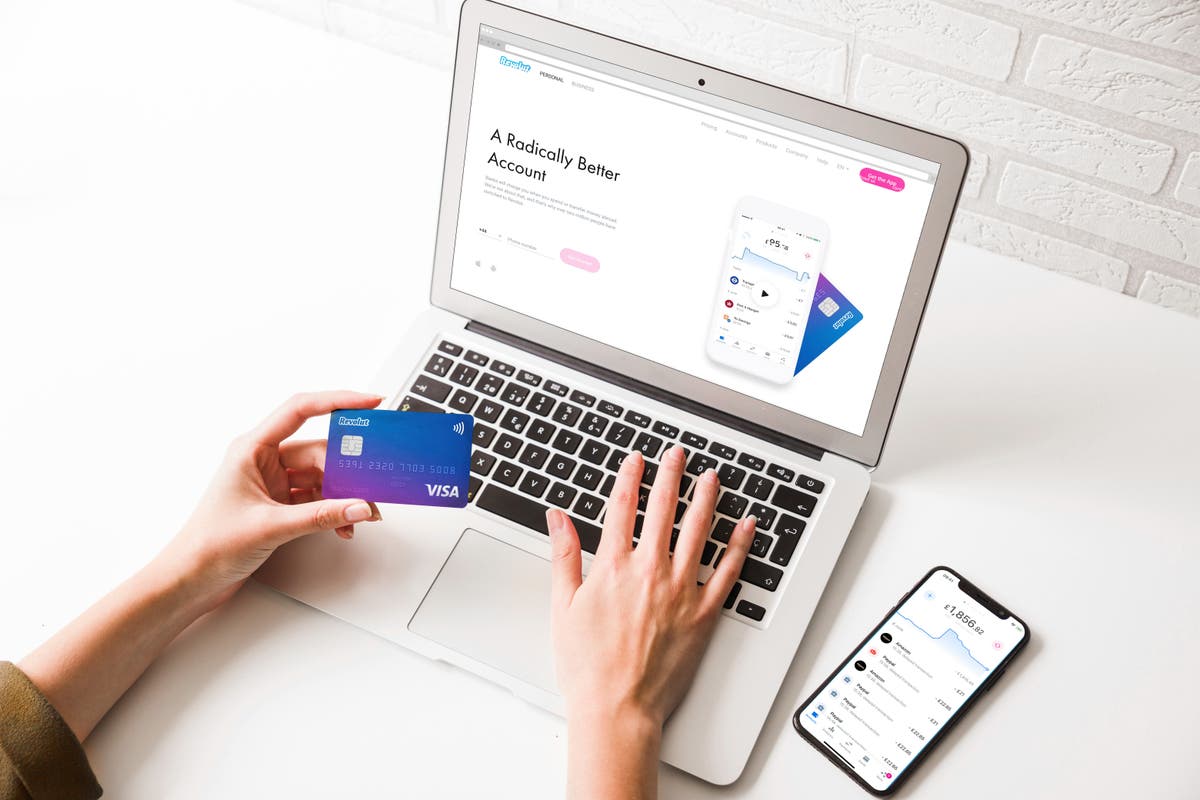

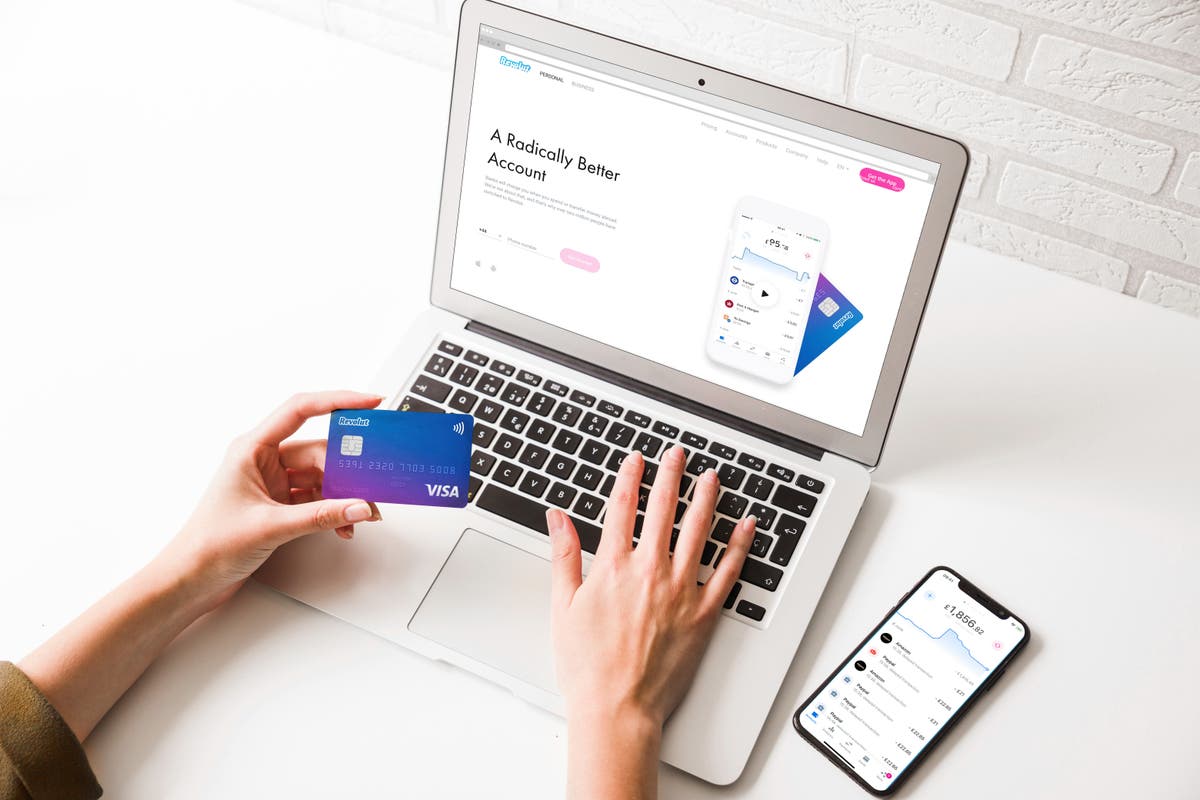

Revolut Secures UK Banking Licence After Delay

Revolut has finally secured its UK banking licence after a three-year struggle with the Prudential Regulation Authority, allowing it to hold customer deposits and offer lending products like mortgages and credit cards. The company, which boasts 45 million customers globally, faced challenges including revenue verification issues during the licensing process. Although the licence is granted, it comes with restrictions, meaning Revolut cannot immediately launch new products. CEO Nik Storonsky and UK chief Francesca Carlesi expressed pride in reaching this milestone and emphasized their commitment to enhancing customer financial experiences. This move positions Revolut favorably for further expansion and regulatory acceptance in larger markets like the U.S. and aligns with a broader trend of digital-only banks challenging traditional banking systems.

- Total News Sources

- 1

- Left

- 1

- Center

- 0

- Right

- 0

- Unrated

- 0

- Last Updated

- 108 days ago

- Bias Distribution

- 100% Left

Negative

20Serious

Neutral

Optimistic

Positive

Stay in the know

Get the latest news, exclusive insights, and curated content delivered straight to your inbox.