- Total News Sources

- 1

- Left

- 0

- Center

- 0

- Right

- 1

- Unrated

- 0

- Last Updated

- 314 days ago

- Bias Distribution

- 100% Right

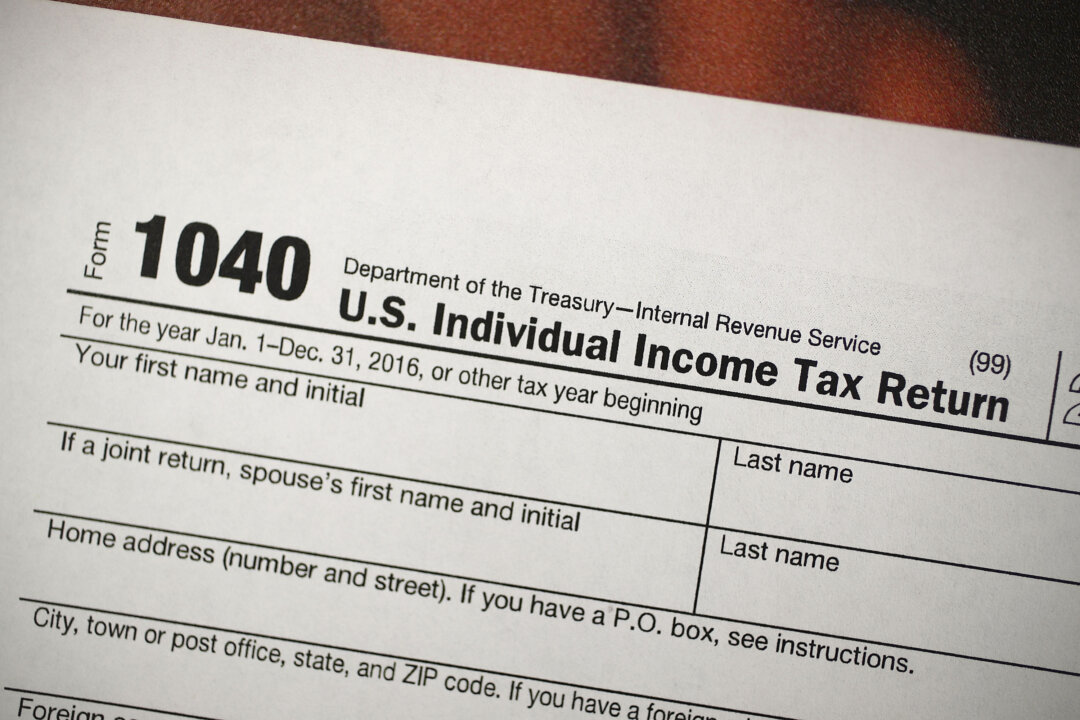

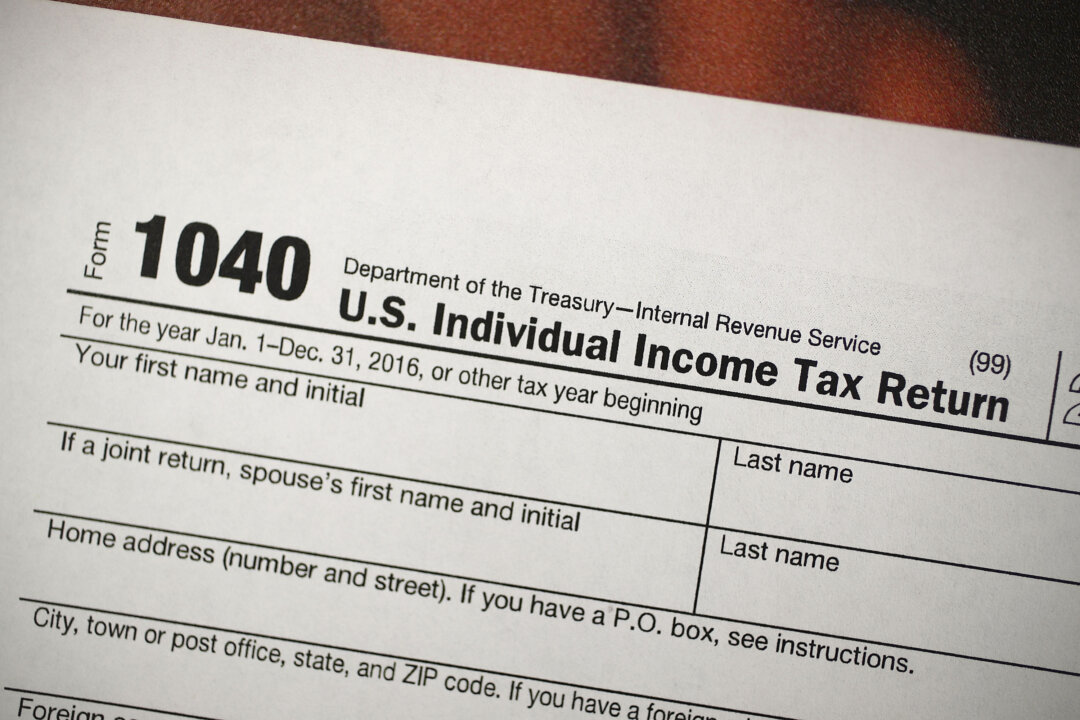

IRS Extends Tax Relief Deadlines for Tennessee, Arkansas Storm Victims

The IRS has announced tax relief for individuals and businesses in Tennessee and Arkansas affected by severe storms, tornadoes, and flooding that began on April 2, 2025. Taxpayers in these states now have until November 3, 2025, to file various federal tax returns and make payments originally due during this period. This includes individual income tax returns, contributions to IRAs, quarterly estimated tax payments, and corporate returns. The relief applies to all counties designated by FEMA, and penalties for late payroll and excise tax deposits will be waived if paid by April 17, 2025. The IRS will automatically provide this relief to taxpayers with an address in the disaster areas, eliminating the need for them to contact the agency for assistance. Further details can be found on the IRS's disaster assistance page.

- Total News Sources

- 1

- Left

- 0

- Center

- 0

- Right

- 1

- Unrated

- 0

- Last Updated

- 314 days ago

- Bias Distribution

- 100% Right

Related Topics

Stay in the know

Get the latest news, exclusive insights, and curated content delivered straight to your inbox.

Gift Subscriptions

The perfect gift for understanding

news from all angles.