Negative

26Serious

Neutral

Optimistic

Positive

- Total News Sources

- 1

- Left

- 0

- Center

- 0

- Right

- 1

- Unrated

- 0

- Last Updated

- 13 hours ago

- Bias Distribution

- 100% Right

BlackRock Bitcoin ETF Surpasses Gold ETF with $6.96B YTD Inflows

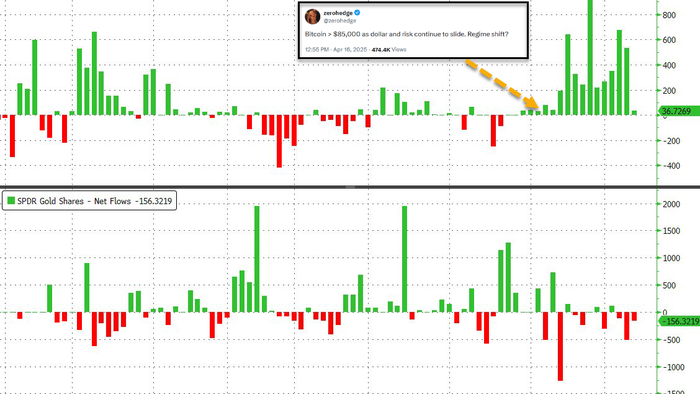

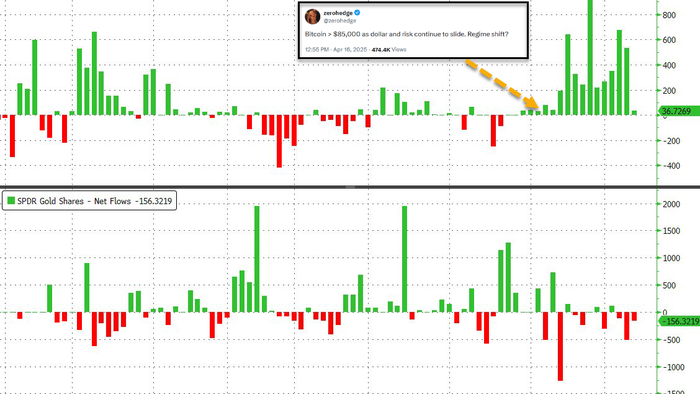

Despite gold's strong price performance in 2025—with a nearly 29% year-to-date surge—BlackRock’s spot Bitcoin ETF (IBIT) has surpassed the SPDR Gold Trust (GLD) in net inflows, attracting $6.96 billion compared to GLD's $6.5 billion. This shift marks a significant change in investor behavior as institutional and retail investors increasingly favor Bitcoin ETFs, even as Bitcoin has underperformed gold in terms of price gains. Analysts view IBIT’s rapid accumulation of assets and consistent inflows as a sign of growing confidence in Bitcoin’s long-term prospects, with some projecting that Bitcoin ETFs could eventually manage three times the capital of gold ETFs. The trend is further reinforced by data showing IBIT’s assets under management have reached levels that took GLD years to achieve, and by a broader surge in Bitcoin accumulation among both institutional and individual holders. This momentum persists despite market volatility and regulatory uncertainties, suggesting that Bitcoin is solidifying its status as a serious alternative to traditional safe-haven assets for corporate and institutional treasuries. Overall, the growing preference for Bitcoin ETFs over gold reflects a major shift in how investors approach portfolio diversification and risk management.

- Total News Sources

- 1

- Left

- 0

- Center

- 0

- Right

- 1

- Unrated

- 0

- Last Updated

- 13 hours ago

- Bias Distribution

- 100% Right

Negative

26Serious

Neutral

Optimistic

Positive

Related Topics

Stay in the know

Get the latest news, exclusive insights, and curated content delivered straight to your inbox.

Gift Subscriptions

The perfect gift for understanding

news from all angles.