Negative

20Serious

Neutral

Optimistic

Positive

- Total News Sources

- 4

- Left

- 1

- Center

- 3

- Right

- 0

- Unrated

- 0

- Last Updated

- 48 days ago

- Bias Distribution

- 75% Center

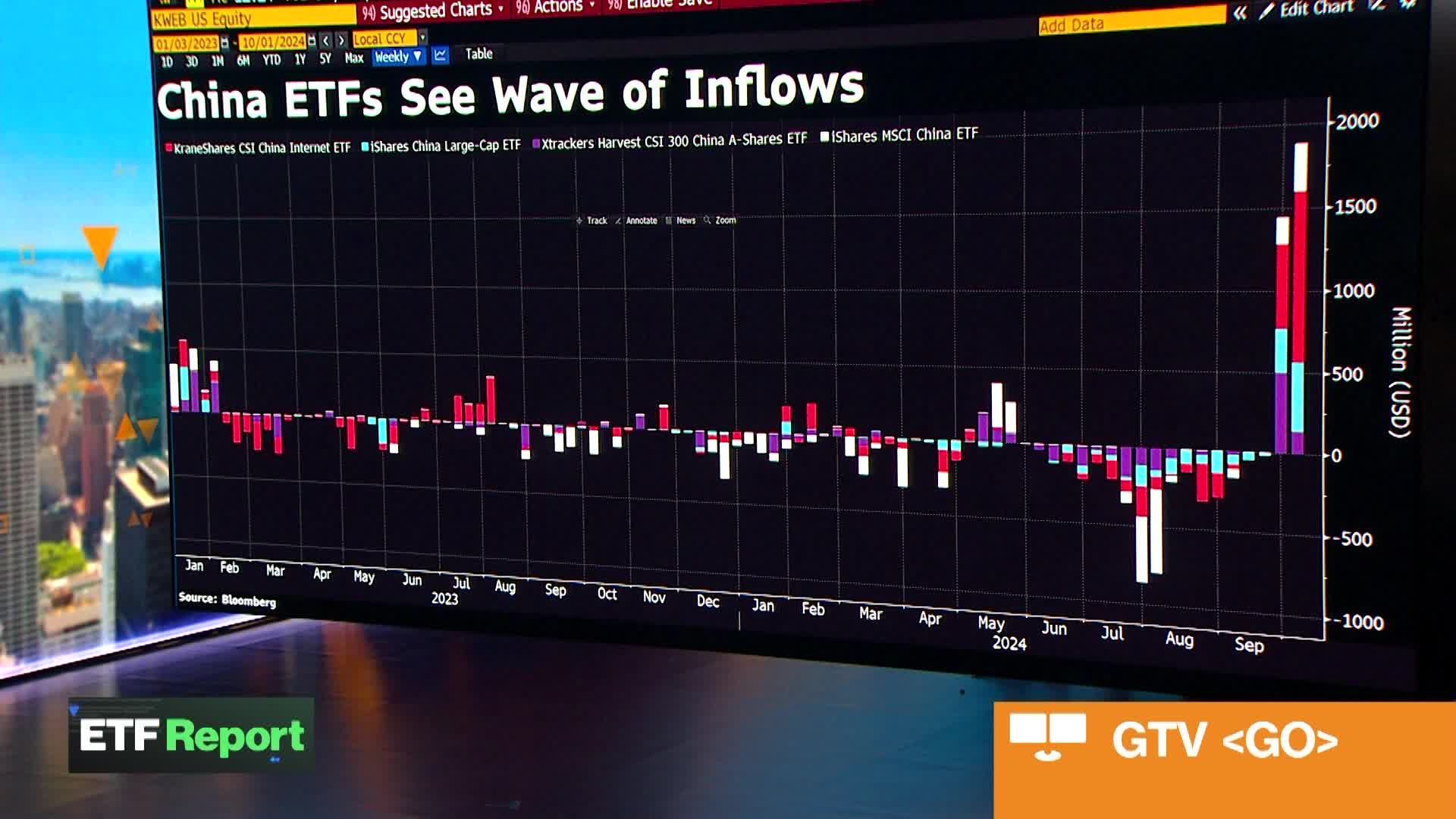

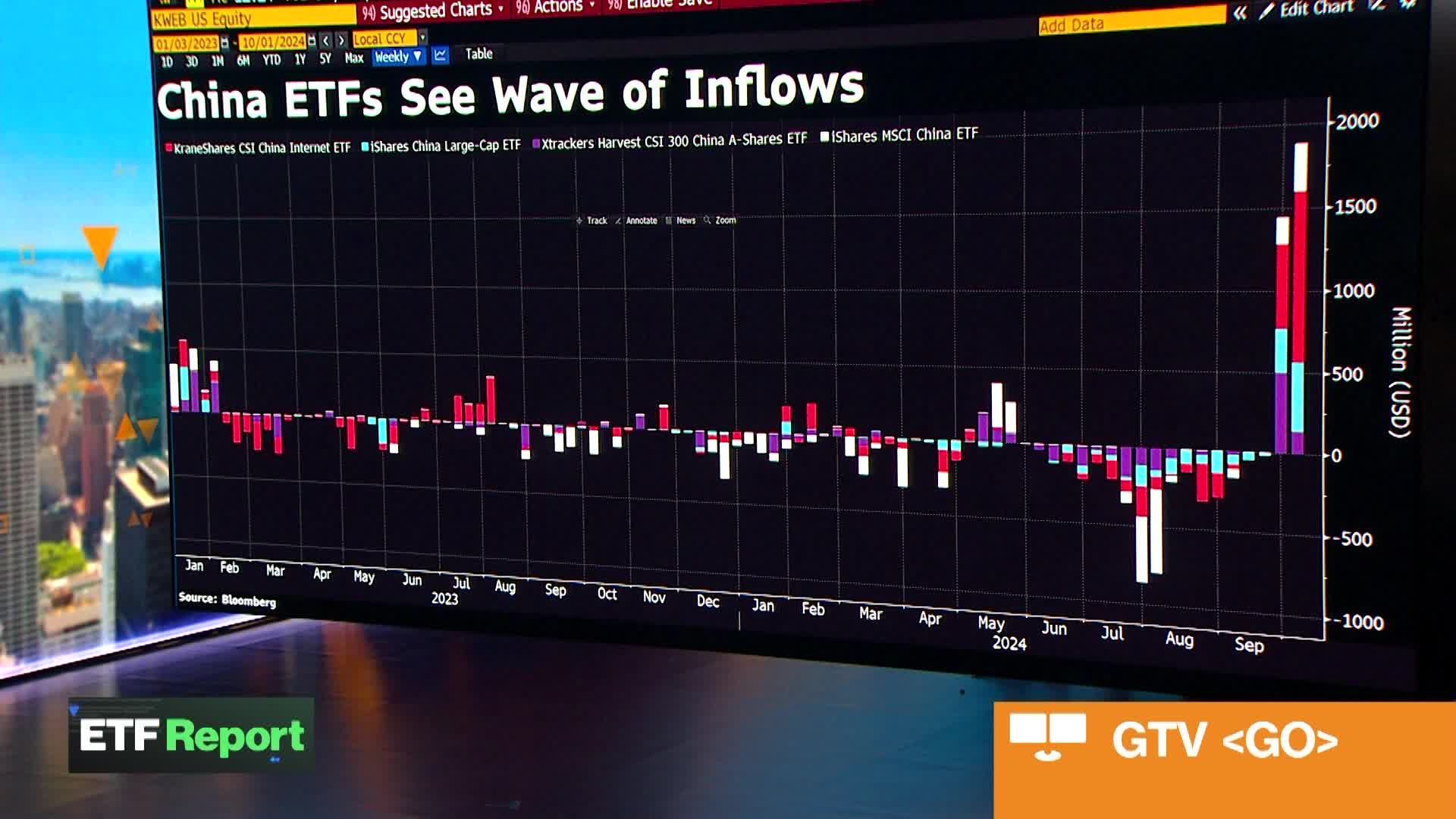

Record Inflows to Chinese Stocks After Stimulus

Hedge funds have dramatically increased their investments in Chinese equities following Beijing's unexpected and expansive stimulus measures, achieving the highest weekly buying activity since records began in 2016, as reported by Goldman Sachs. Key sectors attracting investment include consumer goods, industrials, financials, and technology, while energy saw slight sell-offs. The stimulus, which includes substantial rate cuts and fiscal support, has spurred a significant recovery in Chinese stock markets, with the CSI 300 and Shanghai Composite indices experiencing their largest gains in over a decade. Foreign long-term investors are also showing renewed interest, contributing to $2.4 billion in inflows to China-focused ETFs in just three days, contrasting sharply with earlier outflows this year. Analysts predict further monetary easing and fiscal stimulus will be necessary to sustain this market rally, which could have significant implications for global investor sentiment. Overall, the renewed confidence in China's economy reflects a potential turning point for foreign investment in the region.

- Total News Sources

- 4

- Left

- 1

- Center

- 3

- Right

- 0

- Unrated

- 0

- Last Updated

- 48 days ago

- Bias Distribution

- 75% Center

Open Story

Timeline

Analyze and predict the

development of events

Negative

20Serious

Neutral

Optimistic

Positive

Related Topics

Stay in the know

Get the latest news, exclusive insights, and curated content delivered straight to your inbox.