- Total News Sources

- 1

- Left

- 0

- Center

- 1

- Right

- 0

- Unrated

- 0

- Last Updated

- 172 days ago

- Bias Distribution

- 100% Center

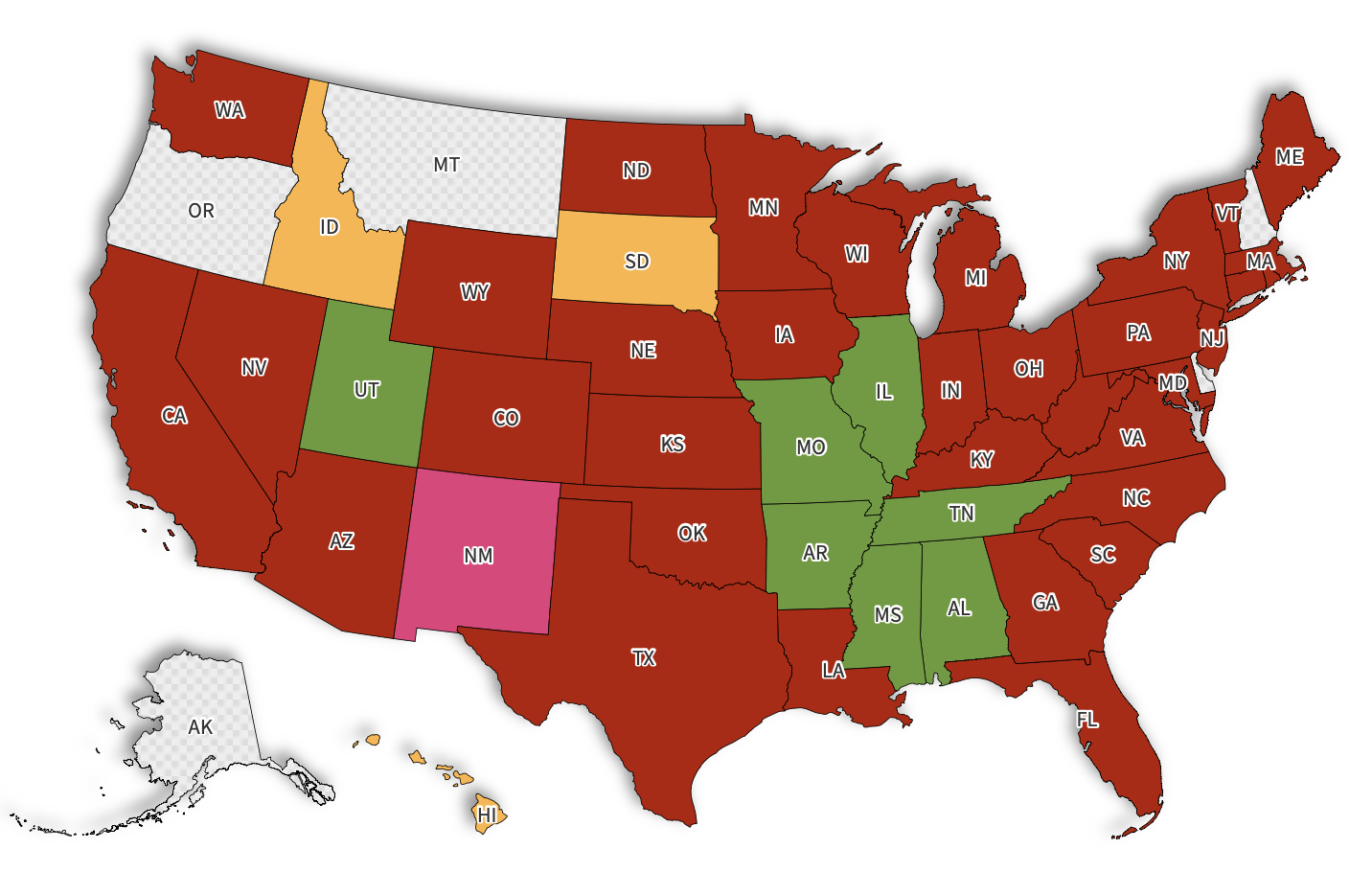

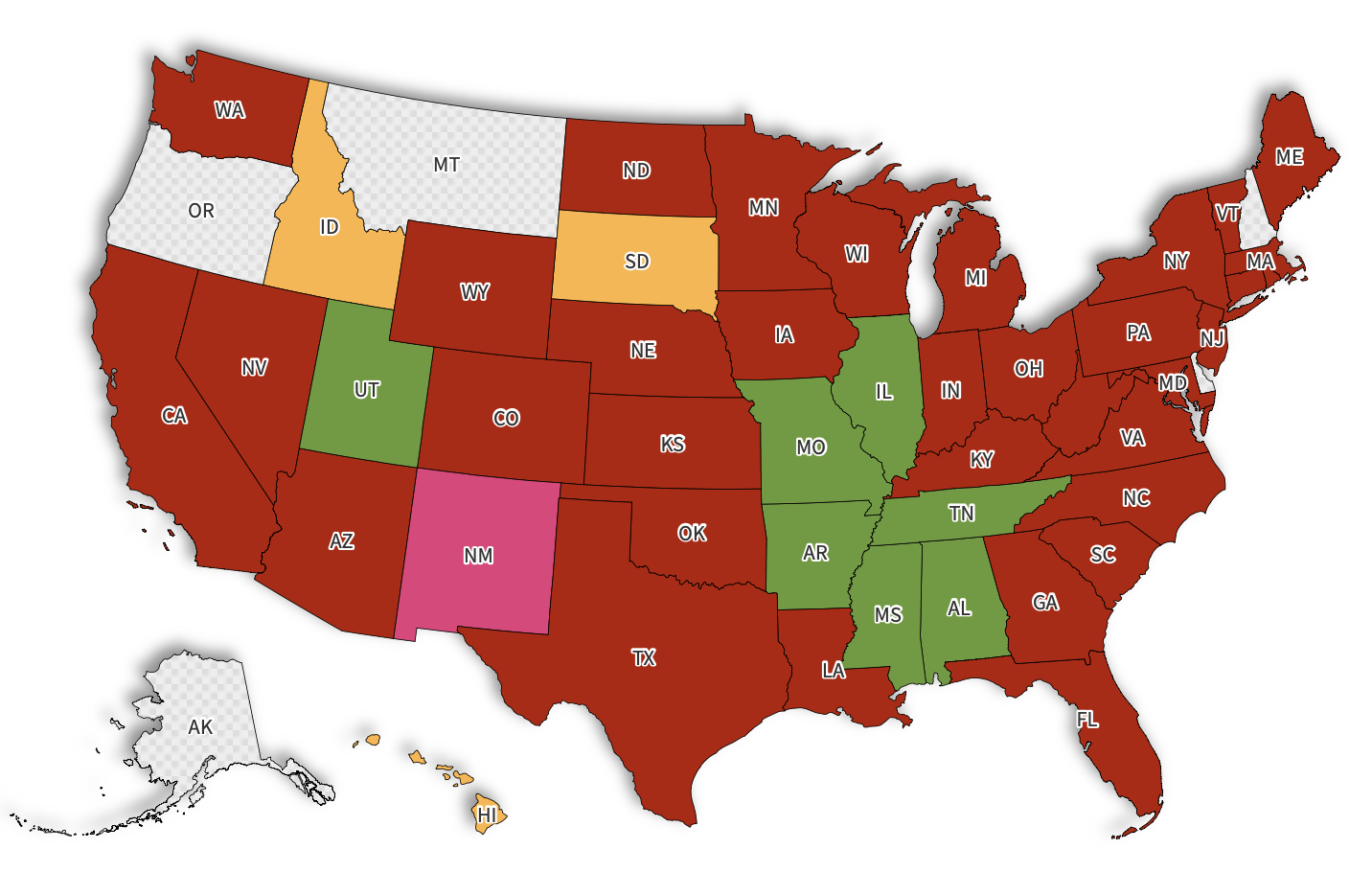

Alabama Reduces State Grocery Tax from 3% to 2% Effective September

Starting September 1, Alabama will reduce its state sales tax on groceries from 3% to 2%, following the signing of House Bill 386 by Governor Kay Ivey. This marks the second reduction since 2023, when the tax dropped from 4% to 3%, and is expected to save Alabama families approximately $121.9 million to $236 annually, depending on the source. The bill also grants local governments more flexibility to lower their own grocery taxes. Advocates like Alabama Arise praise the reduction as a crucial step toward tax justice, particularly benefiting low and moderate-income families, though they continue to push for the complete elimination of the grocery tax. Officials acknowledge the impact on state education funding but see the move as manageable and beneficial amid rising grocery prices. The reduction also includes a removal of the 4% state tax on feminine and baby products, further easing financial burdens on families.

- Total News Sources

- 1

- Left

- 0

- Center

- 1

- Right

- 0

- Unrated

- 0

- Last Updated

- 172 days ago

- Bias Distribution

- 100% Center

Related Topics

Stay in the know

Get the latest news, exclusive insights, and curated content delivered straight to your inbox.

Gift Subscriptions

The perfect gift for understanding

news from all angles.