Negative

21Serious

Neutral

Optimistic

Positive

- Total News Sources

- 1

- Left

- 1

- Center

- 0

- Right

- 0

- Unrated

- 0

- Last Updated

- 5 days ago

- Bias Distribution

- 100% Left

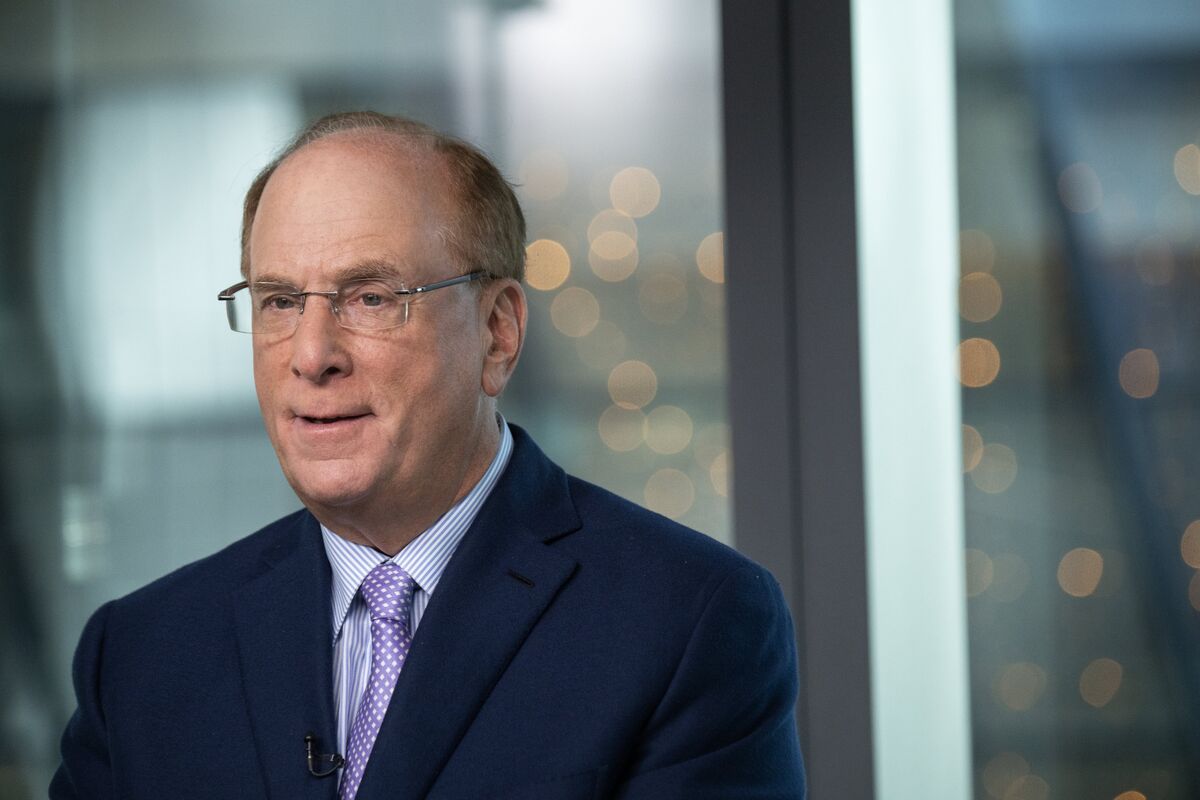

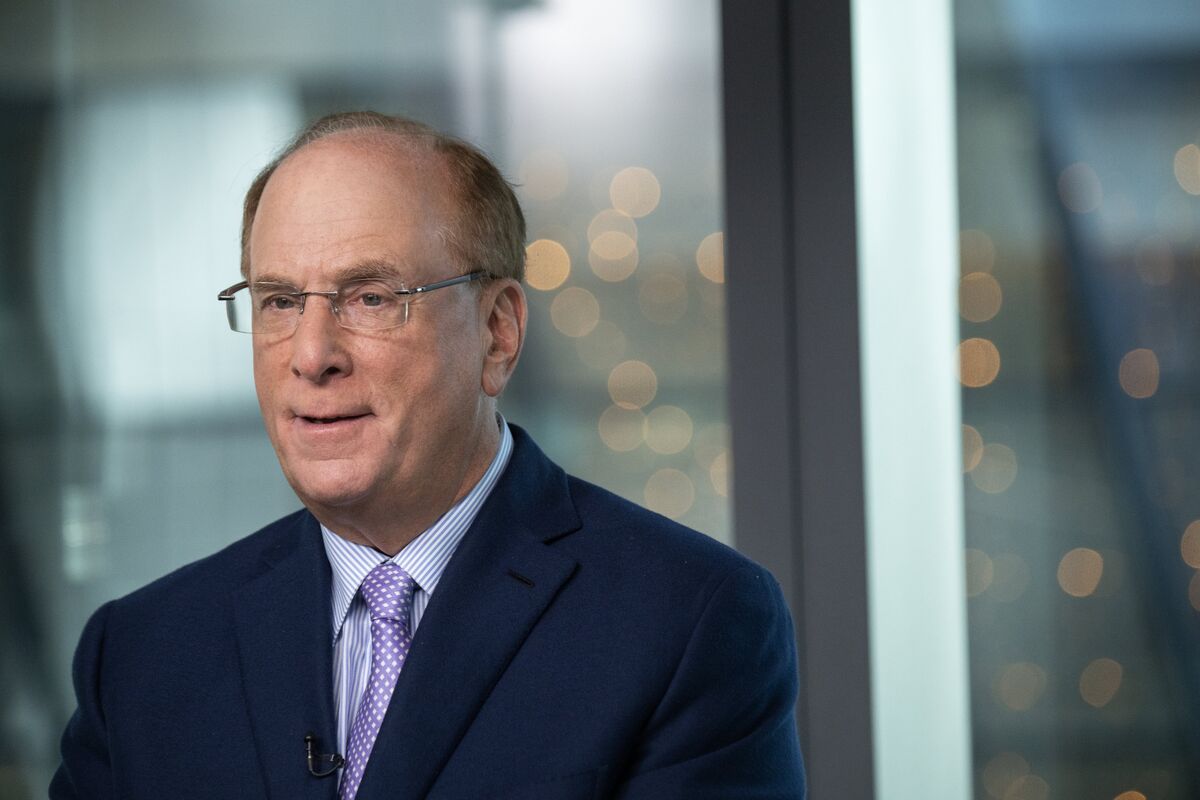

BlackRock CEO Discusses Financial Asset Tokenization

BlackRock CEO Larry Fink is aggressively pursuing investments in private assets, having spent about $16 billion this year to position the company as a leader in infrastructure investment and private credit. Fink believes the future of finance lies in the tokenization of assets, which he claims will enhance security, reduce transaction costs, and improve corporate governance. He envisions a system where every stock and bond has a unique identifier, facilitating real-time settlements and personalized investment strategies. Meanwhile, BlackRock has also launched a new exchange-traded fund (ETF) focused on the largest US companies, reflecting a positive outlook on US equities, particularly due to the impact of artificial intelligence on economic growth. This bullish sentiment has been echoed by other fund managers in light of recent political developments. Overall, BlackRock's strategic moves indicate a significant shift towards private markets and technological advancements in asset management.

- Total News Sources

- 1

- Left

- 1

- Center

- 0

- Right

- 0

- Unrated

- 0

- Last Updated

- 5 days ago

- Bias Distribution

- 100% Left

Negative

21Serious

Neutral

Optimistic

Positive

Related Topics

Stay in the know

Get the latest news, exclusive insights, and curated content delivered straight to your inbox.