- Total News Sources

- 2

- Left

- 0

- Center

- 0

- Right

- 1

- Unrated

- 1

- Last Updated

- 468 days ago

- Bias Distribution

- 100% Right

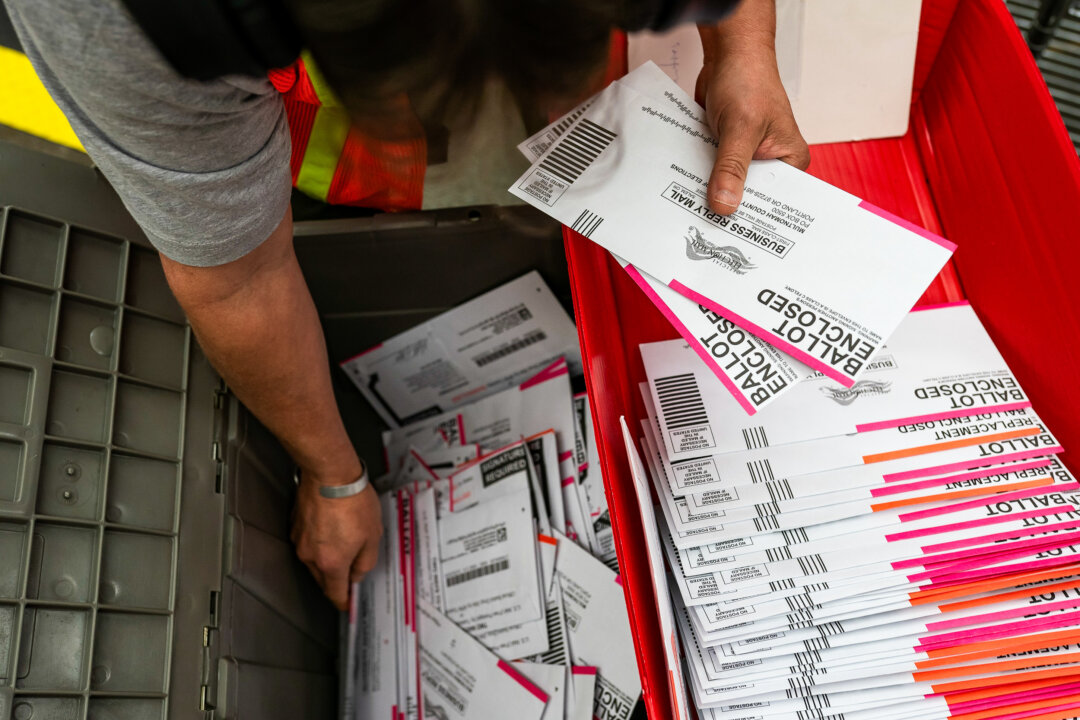

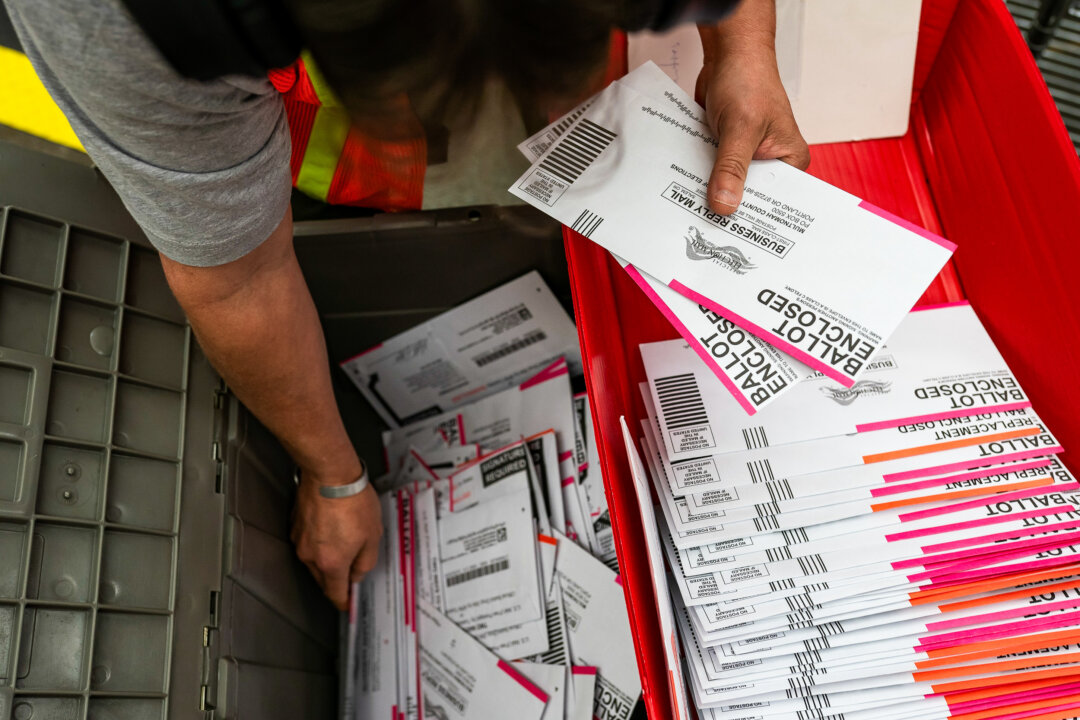

Oregon Voters Reject Corporate Tax Increase Measure

Oregon voters overwhelmingly rejected Measure 118, which aimed to increase corporate taxes on sales exceeding $25 million by 3% to fund a universal basic income for residents. The measure, supported by some progressive groups, faced significant opposition from a coalition of political leaders and businesses, who argued it would lead to higher consumer prices and harm the state's economy. In a similar vein, voters in Argyle and Northwest ISDs turned down proposed tax increases to address budget deficits, leading to concerns about future class sizes and staffing strategies. Meanwhile, North Dakota voters also rejected a property tax reform proposal that would have eliminated assessed value-based taxes, with a significant majority against it. The proposal's critics cited inflated cost estimates while supporters sought meaningful tax relief. Collectively, these outcomes reflect a cautious approach by voters towards tax increases and substantial fiscal reforms.

- Total News Sources

- 2

- Left

- 0

- Center

- 0

- Right

- 1

- Unrated

- 1

- Last Updated

- 468 days ago

- Bias Distribution

- 100% Right

Related Topics

Stay in the know

Get the latest news, exclusive insights, and curated content delivered straight to your inbox.

Gift Subscriptions

The perfect gift for understanding

news from all angles.