Negative

21Serious

Neutral

Optimistic

Positive

- Total News Sources

- 1

- Left

- 1

- Center

- 0

- Right

- 0

- Unrated

- 0

- Last Updated

- 23 hours ago

- Bias Distribution

- 100% Left

European Central Bank Warns of AI Asset Bubble

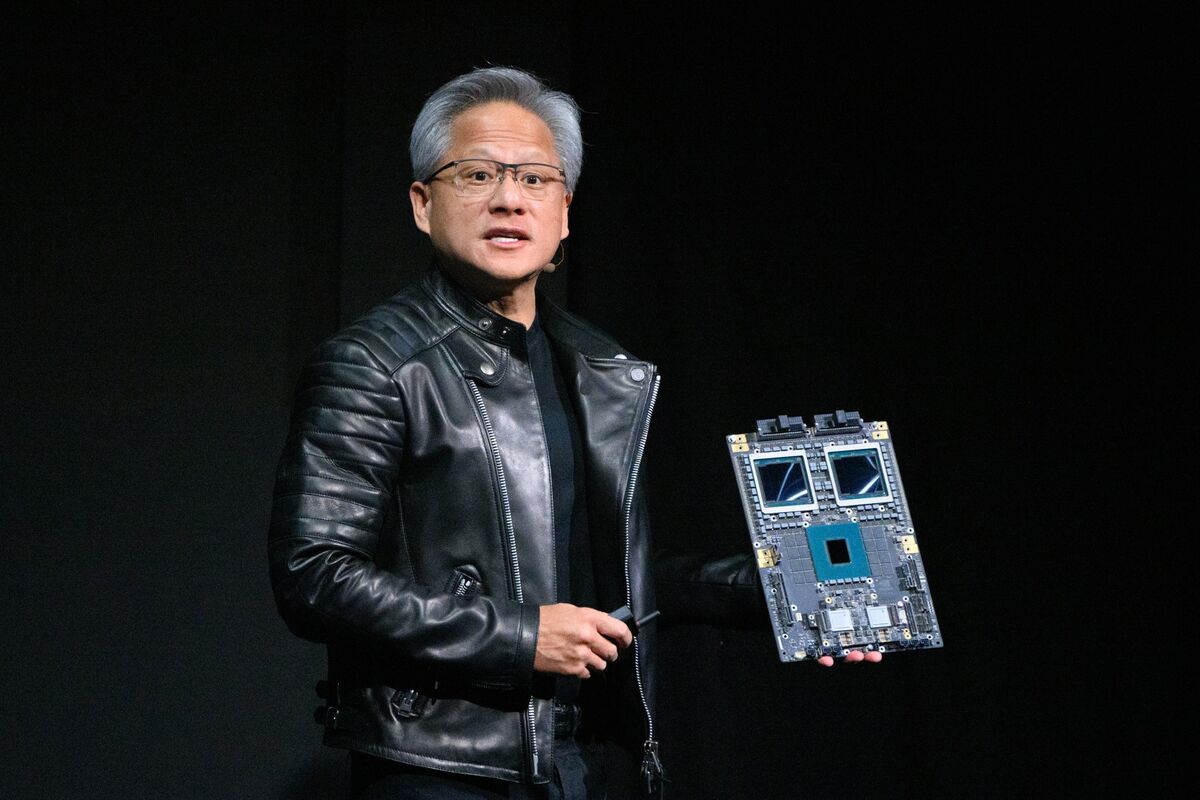

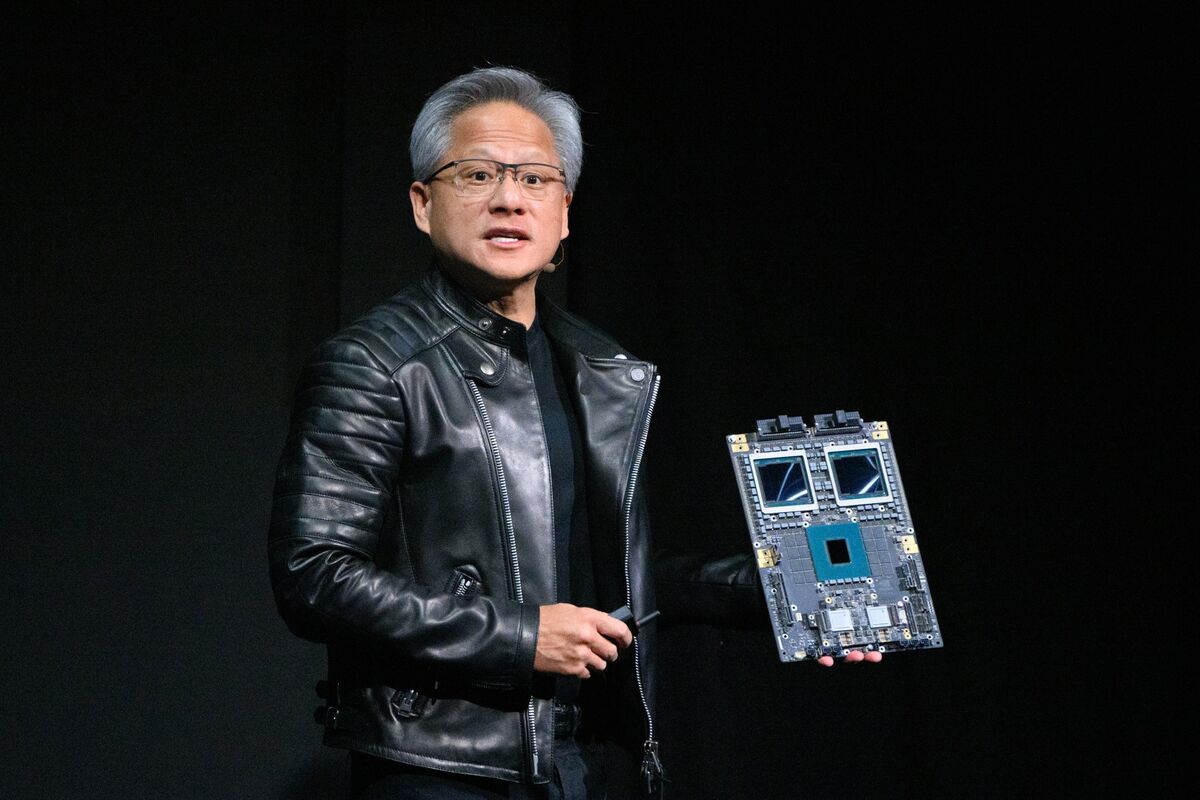

Nvidia Corporation (NASDAQ: NVDA) has reported a record revenue of $35.1 billion for the third quarter, driven by strong demand for its AI-driven products, particularly in the data center segment. CEO Jensen Huang noted that production of the new Blackwell chip is at full capacity, yet demand continues to surpass supply, reflecting a transformational moment in computing as enterprise AI adoption accelerates. The European Central Bank has issued warnings about a potential AI bubble as the stock market increasingly relies on a few major companies, which raises concerns about global financial stability should earnings expectations fall short. Analysts predict significant growth for Nvidia, with stock prices potentially rising to between $150 and $180 by the end of 2024, underscoring its pivotal role in the tech sector. Additionally, Nvidia's active efforts to expand its customer base and influence how AI technology is deployed may help mitigate risks associated with dependency on a small group of major clients. As Nvidia and similar companies navigate this evolving landscape, they are expected to benefit significantly from a projected AI market that could reach between $171 billion and $174 billion by 2027.

- Total News Sources

- 1

- Left

- 1

- Center

- 0

- Right

- 0

- Unrated

- 0

- Last Updated

- 23 hours ago

- Bias Distribution

- 100% Left

Negative

21Serious

Neutral

Optimistic

Positive

Related Topics

Stay in the know

Get the latest news, exclusive insights, and curated content delivered straight to your inbox.