- Total News Sources

- 1

- Left

- 1

- Center

- 0

- Right

- 0

- Unrated

- 0

- Last Updated

- 198 days ago

- Bias Distribution

- 100% Left

Private Credit Market Nears $3 Trillion Growth Amid Global Expansion

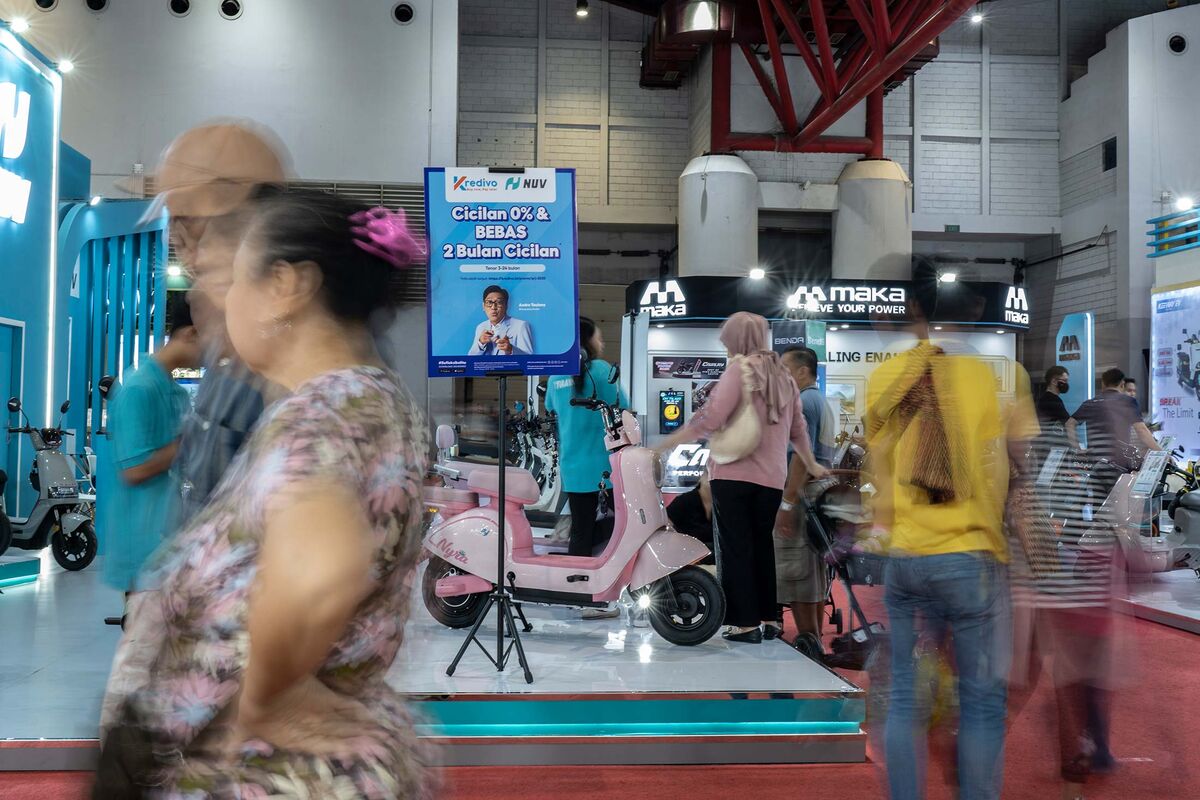

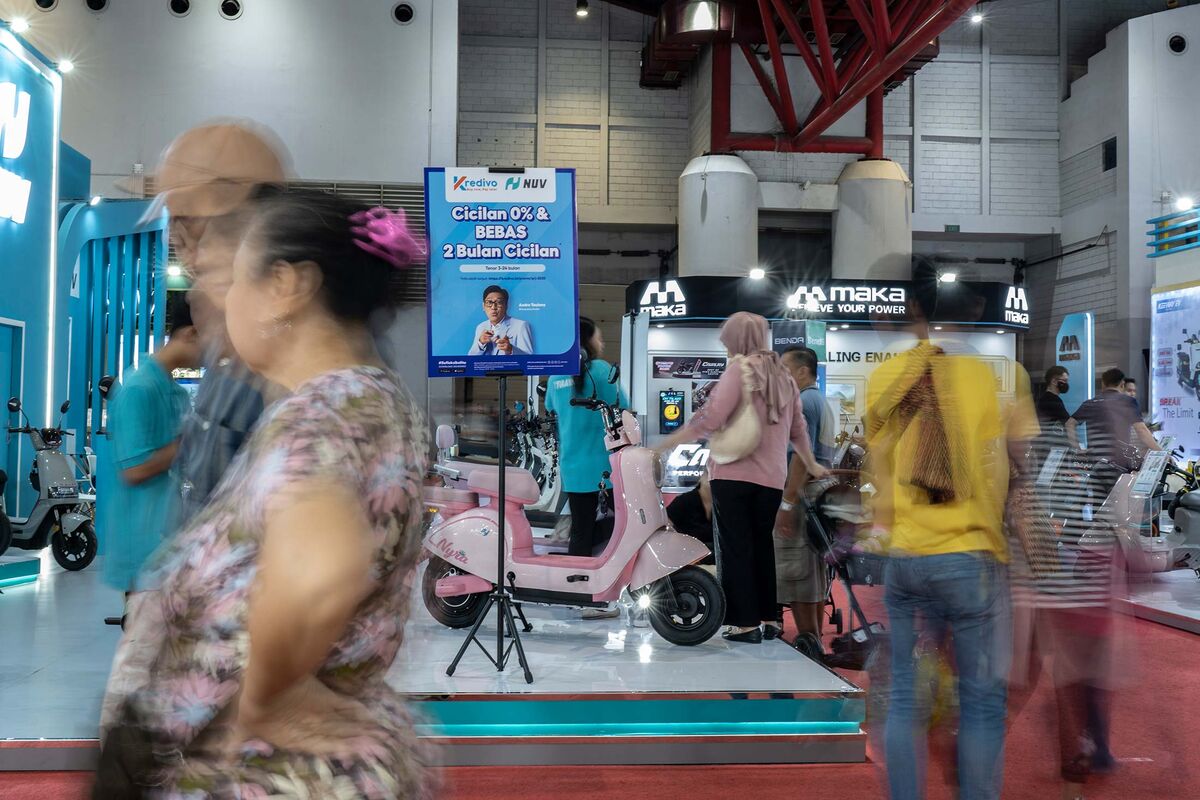

Private credit has grown from a niche market to a significant funding source, increasingly targeting blue-chip companies like Boeing, EDF, and Meta for large financing deals. This shift challenges traditional investment grade bond markets, which provide competitively priced funding and long-term strategic relationships, pushing private credit to evolve beyond short-term solutions to become a stable, strategic funding partner. In the Gulf region, sovereign wealth funds like Mubadala and ADIA are collaborating with major U.S. financial firms to create substantial private credit funds, reflecting the asset class's rising prominence despite concerns over its opacity and potential financial risks. JPMorgan CEO Jamie Dimon has warned that private credit could be a “recipe for a financial crisis,” highlighting the risks amid its rapid expansion and complexity. Additionally, private credit fuels consumer lending growth in Asia, exemplified by high-interest 'buy now, pay later' loans that offer quick access to funds but at steep rates, as seen in the Philippines. Investors are advised to understand private credit’s risk-return dynamics, liquidity, and diversification features, as this asset class continues to attract attention amid market volatility and evolving regulatory landscapes.

- Total News Sources

- 1

- Left

- 1

- Center

- 0

- Right

- 0

- Unrated

- 0

- Last Updated

- 198 days ago

- Bias Distribution

- 100% Left

Stay in the know

Get the latest news, exclusive insights, and curated content delivered straight to your inbox.

Gift Subscriptions

The perfect gift for understanding

news from all angles.