Negative

26Serious

Neutral

Optimistic

Positive

- Total News Sources

- 2

- Left

- 0

- Center

- 1

- Right

- 1

- Unrated

- 0

- Last Updated

- 26 days ago

- Bias Distribution

- 50% Center

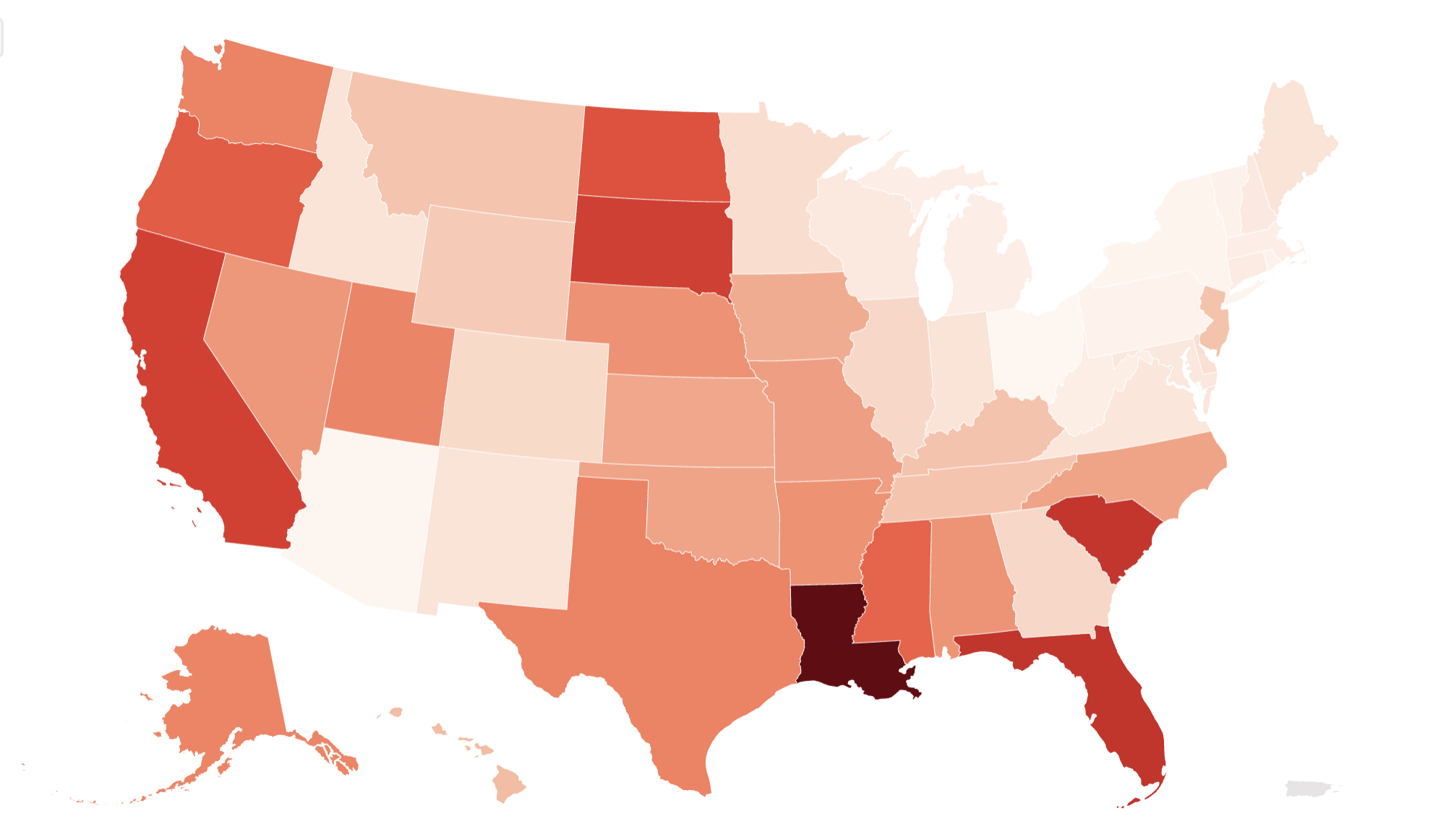

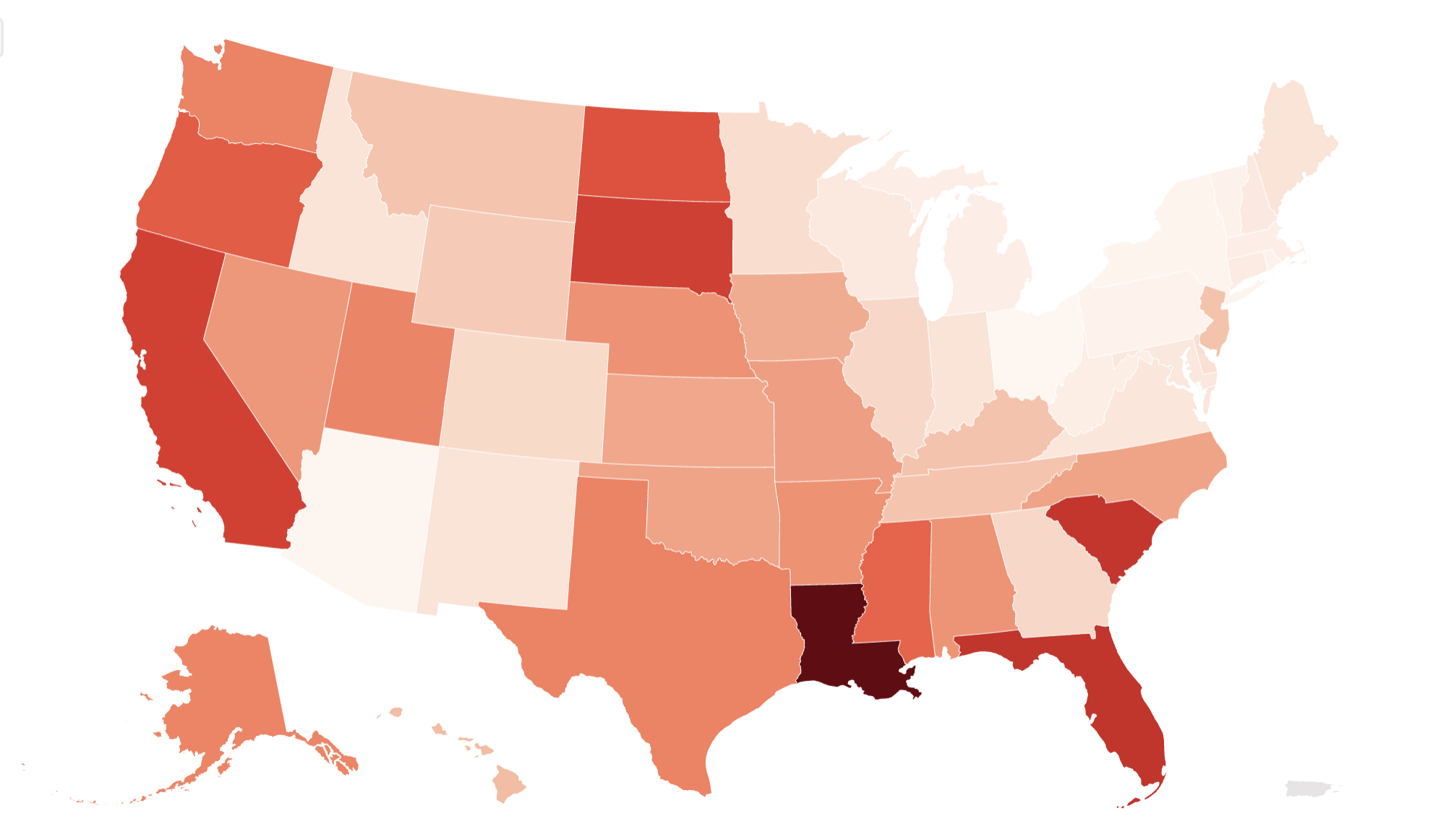

Natural Disaster Risks Raise Home Insurance Costs, Threaten Coastal States

Homeowners across the United States are facing increasing risks and financial burdens due to severe weather and natural disasters, notably hurricanes, floods, and storms. Louisiana is projected to have the highest average annual financial losses per resident from natural hazards, with $547 per person, followed by Florida with $416, amid an anticipated above-average hurricane season. These growing risks are driving up home insurance costs and making coverage harder to obtain, creating a crisis in the housing market that some experts believe may require government intervention. The rising costs are compounded by a housing market slowdown, with home sales at their lowest in 16 years due to high mortgage payments, rising insurance rates, and economic uncertainty. Additionally, technological advances like microwave satellite sensors are improving storm tracking, but inland areas remain vulnerable to severe impacts, as exemplified by past hurricanes causing flooding far from the coast. Similar challenges are seen internationally, such as in South Africa, where extreme weather events are increasing and preparedness efforts are ongoing.

- Total News Sources

- 2

- Left

- 0

- Center

- 1

- Right

- 1

- Unrated

- 0

- Last Updated

- 26 days ago

- Bias Distribution

- 50% Center

Negative

26Serious

Neutral

Optimistic

Positive

Related Topics

Stay in the know

Get the latest news, exclusive insights, and curated content delivered straight to your inbox.

Gift Subscriptions

The perfect gift for understanding

news from all angles.